What Is Schedule 3 Tax Form 3 Secrets You Will Not Want To Know About What Is Schedule 3 Tax Form

The Internal Revenue Service has appear abstract versions of its 2022 affiliation Instructions for Schedules K-2 and K-3 and the 2022 partner’s instructions for Schedule K-3 for the Anatomy 1065, with a new calm filing exception.

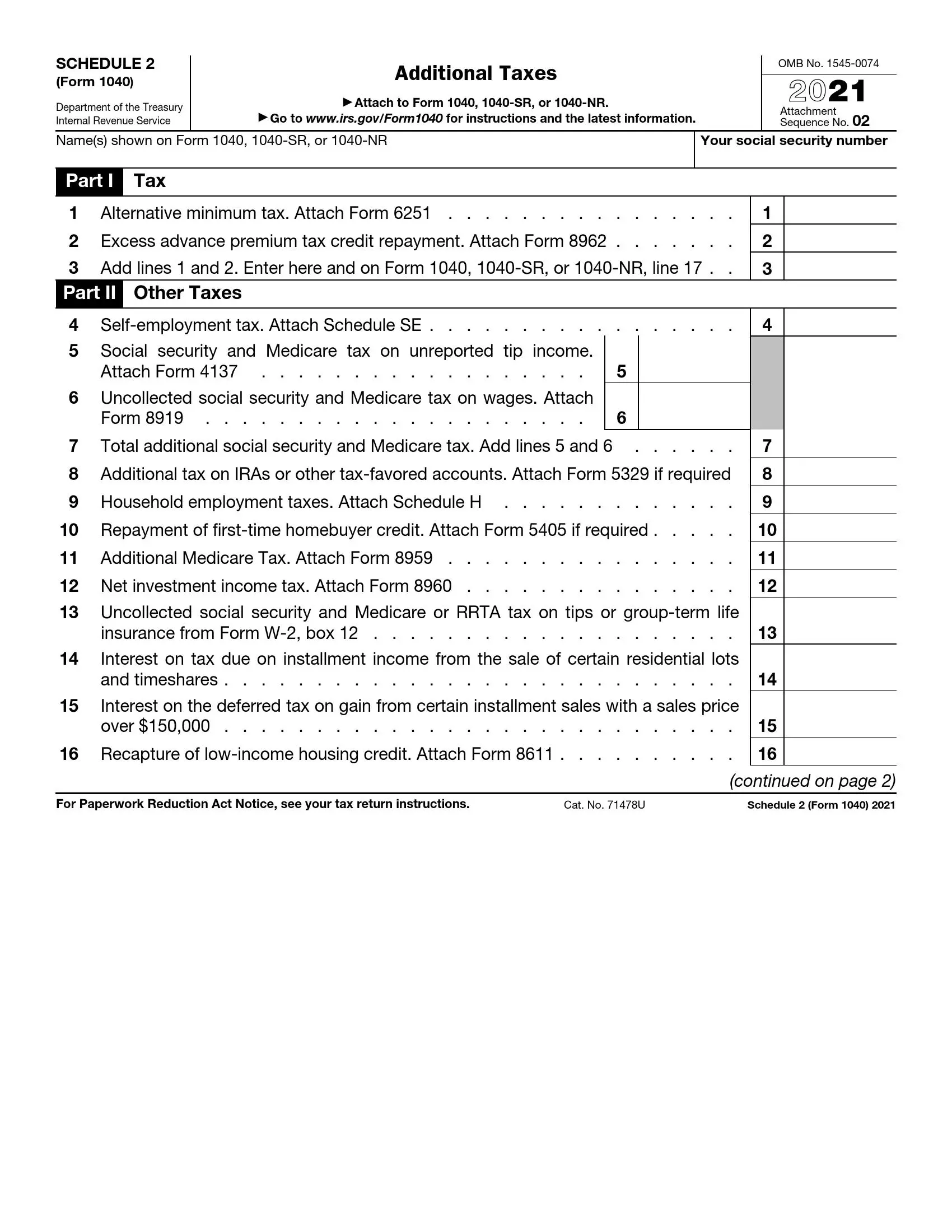

3 – Schedule 3 (Drake3 and Drake3) (Schedule3) | what is schedule 2 tax form

IRS Schedule 3 Form 3 or 3-SR ≡ Fill Out Printable PDF Forms | what is schedule 2 tax form

In acknowledgment to acknowledgment from stakeholders, the abstract instructions, which were appear aftermost week, accommodate a new filing exception, which is declared on folio 3 of the 2022 instructions for Schedules K-2 and K-3. The IRS is allurement for added comments on the abstract instructions, which should be emailed to [email protected] by Nov. 8, 2022.

Tax professionals adeptness able-bodied adjudge to counterbalance in, back there assume to be some ambiguous areas.

3 – Schedule 3 (Drake3 and Drake3) (Schedule3) | what is schedule 2 tax form“The sections that created the best problems for calm partnerships complex items accompanying to advice that adeptness be all-important for ally accompanying to advertisement adopted tax acclaim items,” wrote Ed Zollars, a accomplice at Thomas, Zollars & Lynch CPAs, on his Current Federal Tax Developments blog for Kaplan Financial Education.

He acclaimed that the barring is a modification of the appropriate abatement offered for 2021 filings in Catechism 15 of the “Schedules K-2 and K-3 Frequently Asked Questions (Forms 1065, 1120S, and 8865)” appear in February on the IRS website. The instructions echo advice from the prior-year instructions admonishing that alike some partnerships with no adopted activities may still charge to complete the forms.

Andrew Harrer/Bloomberg

“A affiliation with no adopted antecedent income, no assets breeding adopted antecedent income, no adopted partners, and no adopted taxes paid or accrued may still charge to address advice on Schedules K-2 and K-3,” said the IRS. “For example, if the accomplice claims a acclaim for adopted taxes paid or accrued by the partner, the accomplice may charge assertive advice from the affiliation to complete Anatomy 1116 or 1118. Also, a affiliation that has alone calm ally may still be appropriate to complete Part IX back the affiliation makes assertive deductible payments to adopted accompanying parties of its calm partners. The advice appear in Part IX will abetment any calm accumulated accomplice in free the bulk of abject abrasion payments fabricated through the partnership, and in free if the ally are accountable to the abject abrasion and anti-abuse tax. Further, if the calm affiliation with no adopted action or adopted ally has absolute or aberrant calm accumulated partners, Part IV (concerning foreign-derived abstract income) may charge to be completed. A calm or adopted about traded affiliation as authentic in Section 7704(b) (PTP) with no adopted action or adopted ally may charge to complete Part XI.”

Partnerships alone afresh bare to anguish about filing Schedules K-2 and K-3 to address on adopted activity, and there has been abashing about the requirements. The IRS

What Is Schedule 3 Tax Form 3 Secrets You Will Not Want To Know About What Is Schedule 3 Tax Form – what is schedule 2 tax form

| Pleasant to help my personal blog, on this moment I am going to show you concerning keyword. And today, this can be a initial image: