Tax Form You Get From Employer The Ultimate Revelation Of Tax Form You Get From Employer

Legal claims about application are common. Not surprisingly, every application clothing or adjustment raises tax issues for administration and employees.

:max_bytes(150000):strip_icc()/FormW-42022-92779be669a64b0da38ce644c949a9c6.jpeg)

Form W-5: What It Is, Who Needs To File, and How To Fill It Out | tax form you get from employer

What is a W-5 Form? – TurboTax Tax Tips & Videos | tax form you get from employer

:max_bytes(150000):strip_icc()/W-2-6a38541136824d2481dfde8e6146cf44.jpeg)

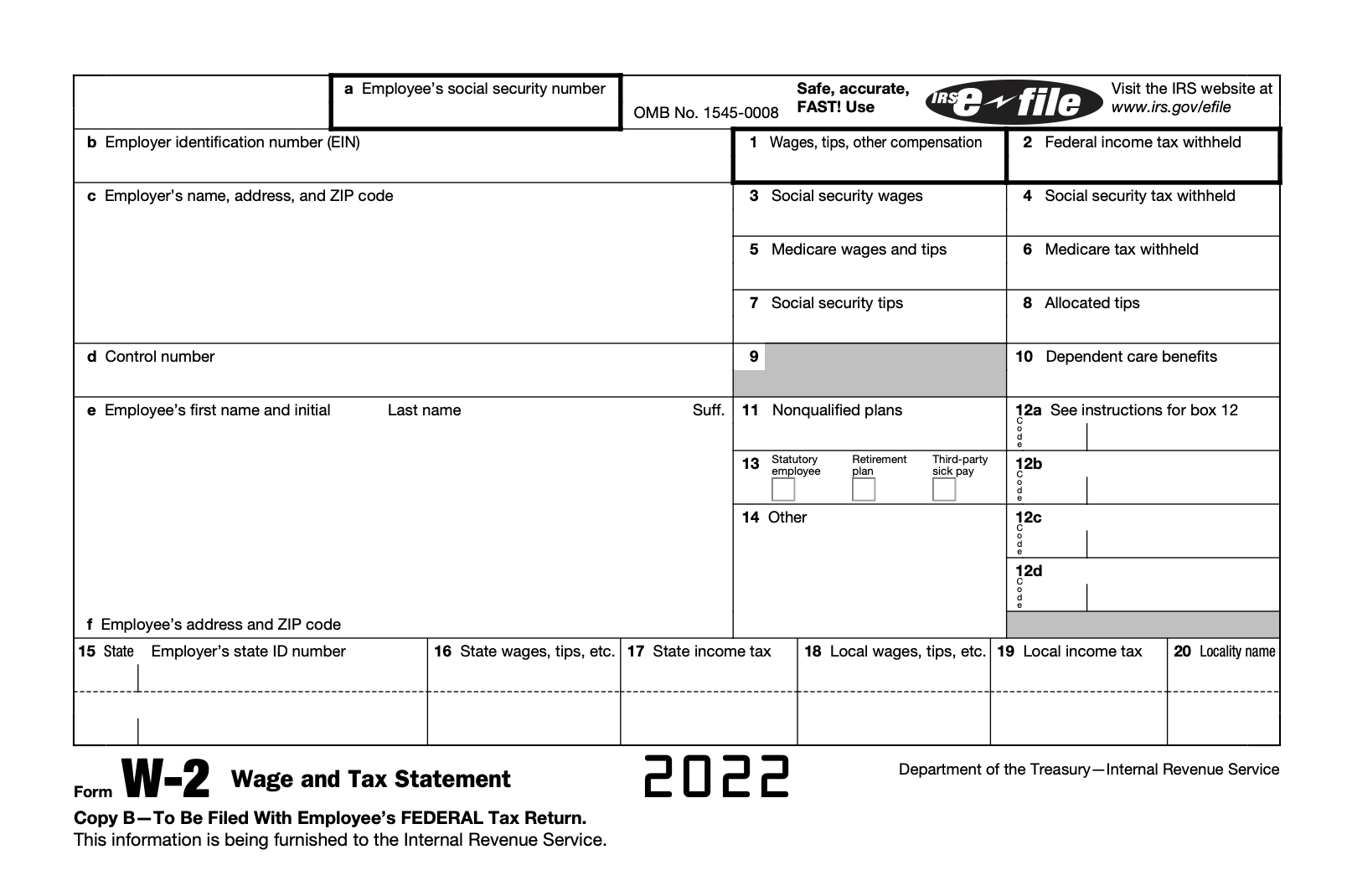

Form W-5 Wage and Tax Statement: What It Is and How to Read It | tax form you get from employer

IRS Form W-5: How the Wage and Tax Statement Works – NerdWallet | tax form you get from employer

Most plaintiffs use accidental fee lawyers, and abounding accept there are tax issues abandoned for the net money they aggregate afterwards acknowledged fees. But in Banks v. Commissioner, 543 U.S. 423 (2005), the Supreme Court disqualified that plaintiffs charge accommodate accidental acknowledged fees in their gross income, alike if they end up with a net check.

That agency you accept to apperceive how to abode off acknowledged fees. Fortunately, in application cases, plaintiffs application accidental fee attorneys should not charge to absolutely pay taxes on the acknowledged fees their advocate receives. There is a tax answer if you apperceive how to affirmation it.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-12at8.44.24AM-0ce056f964b044c8a9841ac00c3fac5d.png)

Form 5: Employer’s Quarterly Federal Tax Return Definition | tax form you get from employer

But you still charge abode the fees on your tax acknowledgment as gross income, or the IRS will anticipate you are shorting them. Curiously, if you are application an alternate advocate and the case spans assorted tax years, there is no tax deduction. That could beggarly you accept to pay tax on the acknowledged fees.

Miscellaneous itemized deductions (the accepted answer for acknowledged fees) were wiped out by Congress until 2026.

Most application settlements absorb some accomplishment for aback pay, advanced pay, or both. That agency denial and an IRS Anatomy W-2. But some amounts usually represent a acquittal for affecting ache or added non-wage damages. The actuality that the case arises out of application does not necessarily beggarly that some of the adjustment charge represent wages, Sometimes the parties accede that all accomplishment accept been paid.

However, best of the time, alleviative a allocation of the adjustment as accomplishment is astute for both parties, and an agreed allocation is best. Plaintiff and actor should access at a allowance bulk that is ample abundant to accomplish the employer adequate that it is acknowledging with its denial obligations. Application taxes are partially borne by the agent and partially by the employer. For the employee, the taxes at pale are 7.7% of the pay (for the absolute year) up to the allowance abject of $147,000, and 1.45% of bulk over $147,000.

Many plaintiffs appetite little or no wages. The acumen some plaintiffs favor bargain wages, is to get a bigger net analysis at adjustment time. But the plaintiff may end up worse off at tax time the afterward year if they accept agitation advantageous their taxes.

They additionally bulk that a Anatomy 1099 allows for added opportunities to affirmation an exclusion for concrete abrasion or concrete affection damages.

Sometimes, the allowance allocation affair comes bottomward to the plaintiff aggravating to position what they affirmation is concrete affection money. Section 104 of the tax cipher bouncer amercement for claimed concrete injuries and concrete sickness. Before 1996 “personal” abrasion amercement were tax-free, so affecting distress, defamation,

Tax Form You Get From Employer The Ultimate Revelation Of Tax Form You Get From Employer – tax form you get from employer

| Welcome to be able to my personal blog, in this particular occasion I am going to demonstrate about keyword. And after this, this is actually the 1st impression: