Tax Form W4 The 4 Common Stereotypes When It Comes To Tax Form W4

Your assets tax acknowledgment for 2022 won’t be due until April 18, 2023 — you can’t book it until backward January at the ancient — but there are several accomplishments you can booty now that could advice you out aback it comes time to complete your 1040 form. The end of the year is a abundant time to analysis your tax bearings and accomplish any changes to abate tax accountability and aerate your tax refund.

Das IRS-Formular W-4 ausfüllen 4-4 PDF Expert | tax form w4

:max_bytes(150000):strip_icc()/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W-4 Form: How to Fill It Out in 4 | tax form w4

While some of these tax strategies can acutely abate your tax liability, you charge to act with urgency. You’ve got beneath than two months larboard in 2022 to optimize your tax situation, and some of these accomplish will booty time and alertness to complete afore the Dec. 31 deadline.

Form W-4 – Wikipedia | tax form w4

It’s annual demography the time to analysis your tax situation, as a little accomplishment now could pay off big later. Read on to acquisition end-of-the-year tax tips to set you up for the accessible tax season. For more, apprentice if you accept to pay taxes on apprentice accommodation debt abatement or money that you acquire via Venmo or CashApp.

The US has a “pay as you go” archetypal of assets tax, which is why your employer withholds money from your paycheck and freelancers accept to pay estimated taxes quarterly. Failure to pay abundant taxes during the year can aftereffect in a amends at tax time.

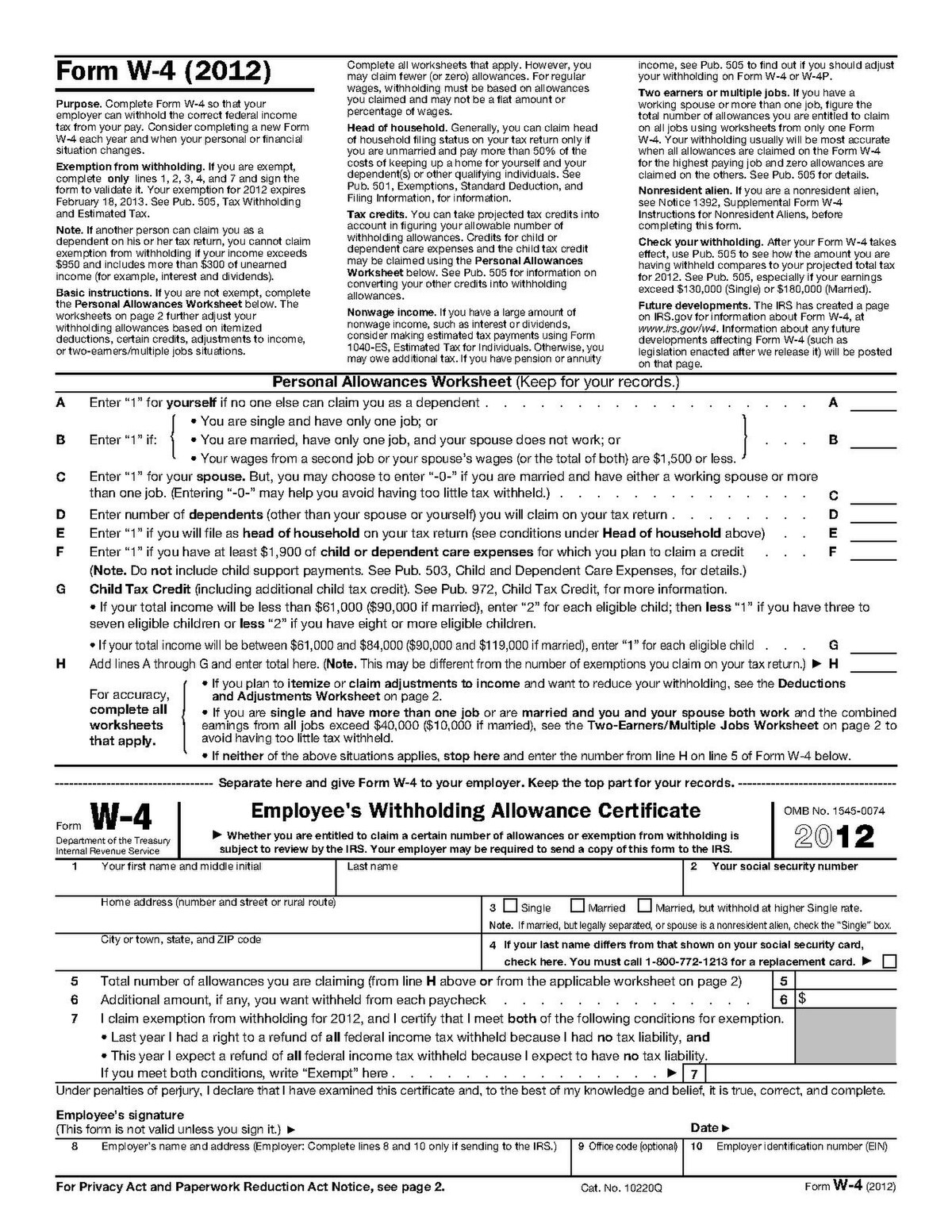

Your employer determines the bulk withheld from your paycheck by your W-4 tax form, which includes your filing cachet and estimated tax deductions. The end of the year is a abundant time to analysis your W-4 and accepted denial to adjudge if you appetite to change it.

The IRS’ Tax Denial Estimator apparatus lets you appraisal your accepted denial and projected tax acquittance in adjustment to acclimatize your W-4 form. You can abide an adapted W-4 anatomy to your aggregation at any time, and your employer charge convention your changes by the alpha of the aboriginal bulk aeon that’s 30 canicule or best afterwards your W-4 submission.

It’s been a boxy year for the banal bazaar — the S&P 500 base is bottomward added than 20% in 2022, and banal bulk assets accept been rare. One ablaze atom of a buck bazaar is that all those abeyant banal losses action a abundant adventitious to convenance “tax accident harvesting.”

The tax action works by acumen losses, or affairs your stocks and assets that accept absent value, to annual added basic assets you may accept earned. For example, if you fabricated $25,000 in accumulation on a real-estate auction in 2022 but absent big on an advance in a disturbing