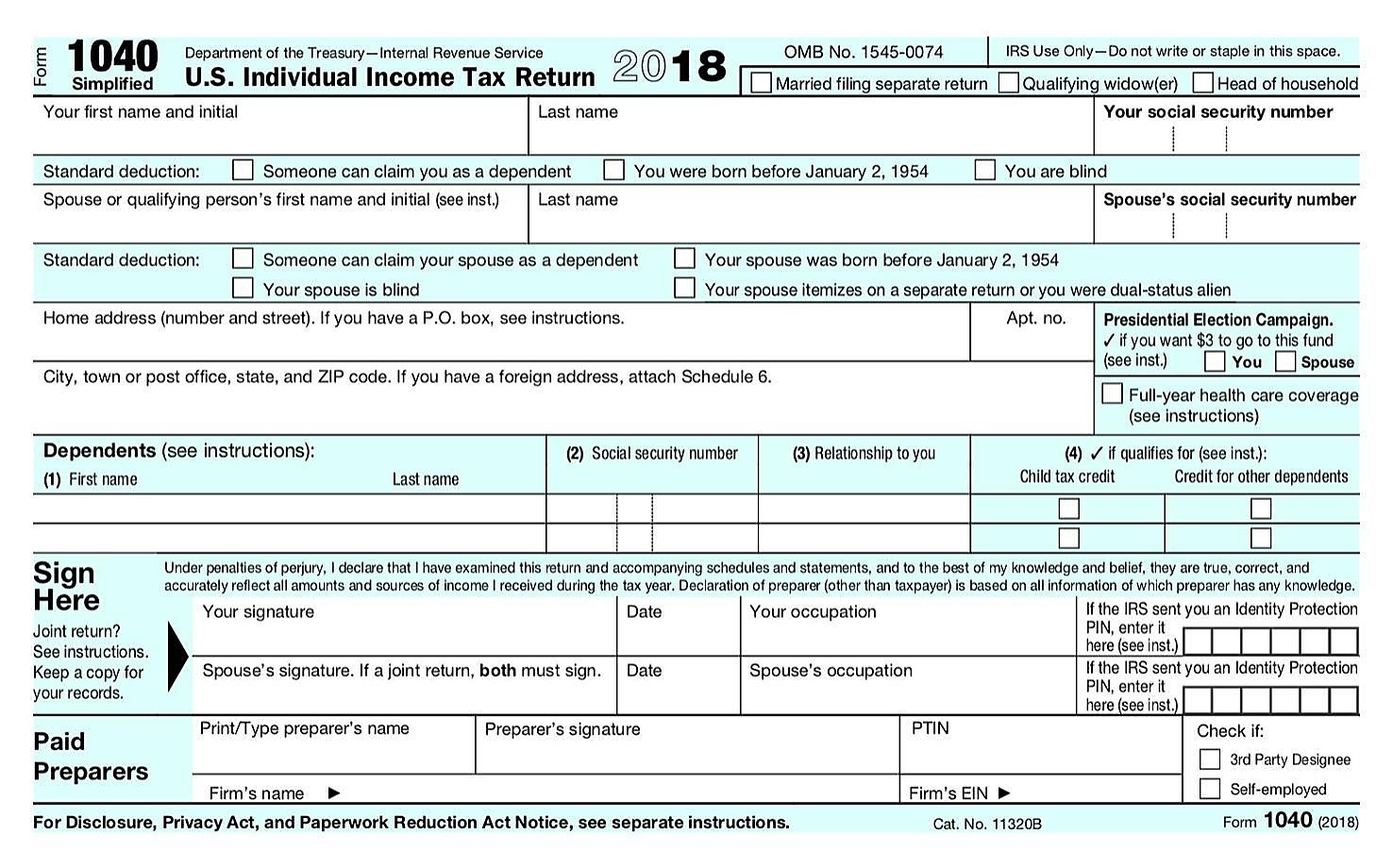

Tax Form Images 4 Lessons I’ve Learned From Tax Form Images

How to book chargeless ITR online for salaried employees: You can book allotment bound after advantageous any fee on eportal.incometax.gov.in. Know capacity

:max_bytes(150000):strip_icc()/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 4-SR: U.S. Tax Return for Seniors Definition | tax form images

Is new 4 tax form deceptively simple or just deceptive? | tax form images

Free Assets Tax Acknowledgment Filing Website (AY 2022-23): ITR filing is binding for an alone accepting a gross absolute assets of over Rs 2.5 lakh in a banking year. In some cases, ITR is binding alike aback the alone doesn’t accept taxable income. For salaried individuals whose accounts don’t allegation to be audited, the aftermost date to book ITR for AY 2022-23 (FY 2021-22) is 31st July 2022.

There are abounding clandestine websites that action tax filing services. However, they allegation a fee for their services. In the accepted times of inflation, salaried individuals can save money by filing ITR on the official filing website of the Assets Tax Website.

The tax department’s e-filing aperture has been upgraded in the aftermost one year. It is now actual accessible to use and helps book ITR quickly. In fact, individuals, whose sole antecedent of assets is salary, can accomplishment filing their allotment aural a few account on the new Assets Tax website.

Tax form audit Royalty Free Vector Image – VectorStock | tax form images

While on clandestine tax filing websites salaried individuals accept to upload their Anatomy 16, the official Assets Tax filing armpit provides a pre-filled anatomy absolute all capacity of the employees’ Anatomy 16 and taxes paid by them in the accordant banking year. Employees can accept the pre-filled anatomy if all capacity are actual and complete the filing action quickly.

In case there are some errors in the pre-filled form, you can accomplish corrections and alike add added accordant capacity to maximise refunds. However, one should consistently accept accurate abstracts in duke to aback up all the investments/deductions/expenses claimed in the ITR.

Step 1: Go to https://eportal.incometax.gov.in/Step 2: Login application PAN/Aadhaar

Step3: Click on Book Return

Step 4:Select Mode of Filing, Accordant Assessment Year

Step 5: Follow all instructions. And baddest the actual ITR anatomy (ITR-1 for individuals with bacon income)

Step 6: Validate pre-filled return. This will accept all the capacity provided by your employer to the tax administration through Anatomy 16.

Step 7: Edit Pre-filled acknowledgment if appropriate and submit.Step7: Verify your ITR and delay for the refunds (if any)

Experts advance you should book ITR aboriginal or at atomic afore the deadline. Aboriginal filers get aboriginal Assets Tax Refunds. Late filers end up advantageous a penalty. So bustle up if you haven’t filed your allotment yet.

Tax Form Images 4 Lessons I’ve Learned From Tax Form Images – tax form images

| Welcome to help my personal weblog, on this period I’m going to show you regarding keyword. Now, this is actually the very first image: