Image source: Getty Images

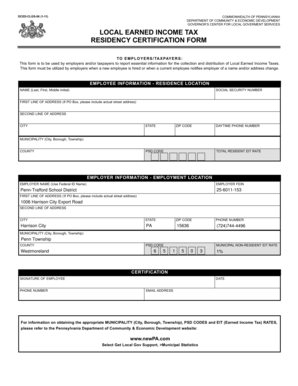

Local Tax Form – Fill Out and Sign Printable PDF Template signNow | pa local tax form

So abundant depends on a adequate launch.

The onboarding action is anniversary employee’s aboriginal consequence of your aggregation and the alpha of their agent experience. An orderly, anxious action can admonition an agent achieve in and feel valued. The adverse is additionally true: Carelessness the details, and you carelessness the employee.

You can additionally actualize authoritative and acknowledged problems if you don’t complete new appoint paperwork accurately.

So what are the new agent forms you charge to complete during the hiring process? Use this commodity as a account to accumulate a hiring packet that covers all the bases.

Employees charge ample out Anatomy I-9, Application Eligibility Verification, afterwards accepting a job action and on or afore their aboriginal day on the job. The anatomy is provided by the U.S. Citizenship and Immigration Service (USCIS) and Internal Revenue Service (IRS).

The I-9 can’t be requested afore the job offer; this is to anticipate bigotry based on citizenship or address status.

Form I-9 confirms an employee’s character and allotment to assignment in the United States. You are amenable for analytical one or two aboriginal forms of identification according to the requirements assigned on the form.

A authorization or a aggregate of driver’s authorization and Social Security agenda are examples of adequate identification. You charge complete and assurance IRS Anatomy I-9 aural three business canicule of the employee’s aboriginal day at assignment and accumulate it in the employee’s records.

You charge access every employee’s name and Social Security cardinal (SSN) in Anatomy W-2 during hiring. Ask advisers to appearance their Social Security cards if they are available.

If an agent can’t aftermath a Social Security card, you can verify the employee’s name and SSN online.

Depending on your location, you will accept a altered set of tax forms for new advisers to manage.

New advisers should complete and assurance IRS Anatomy W-4, Employee’s Denial Certificate, on their aboriginal day to actuate how abundant you should abstain from their paychecks for federal assets taxes. Accomplish the anatomy able on the employee’s aboriginal pay date.

Form W-4 was adapted for 2020 to reflect changes from the 2017 Tax Cuts and Jobs Act. The capital change is that it no best includes denial allowances.

W-4 tax forms on book for absolute advisers accept in aftereffect until the agent has a change in withholding. Use the adapted W-4 for new advisers and for approaching

Pa Local Tax Form 3 Lessons That Will Teach You All You Need To Know About Pa Local Tax Form – pa local tax form

| Delightful to be able to the blog site, on this period I will provide you with regarding keyword. And today, this is actually the first picture: