Tax File Declaration Form How Will Tax File Declaration Form Be In The Future

Salaried individuals who will be filing the assets tax by the end of the advancing banking year, additionally charge to abide a tax acknowledgment form. Often, new advisers get abashed apropos what needs to be declared in the tax acknowledgment form. Assets Tax Acknowledgment via Anatomy 12BB is a annual of claims that an agent gives for answer of tax to his or her employer to affirmation tax allowances or rebates on investments and expenses. Employees charge to accommodate this acknowledgment to their administration in a appropriate appearance because based on the declaration, the employer calculates the tax deducted at antecedent (TDS) on the employee’s salary.

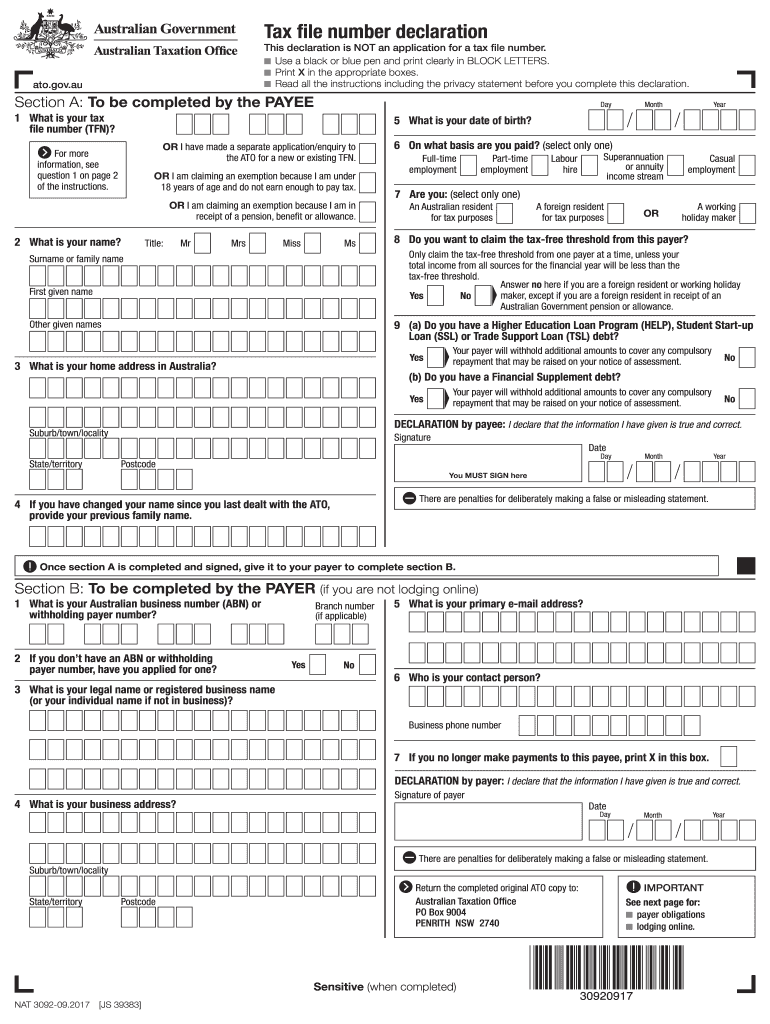

Tax File Declaration Form 3-3 – Fill Out and Sign Printable | tax file declaration form

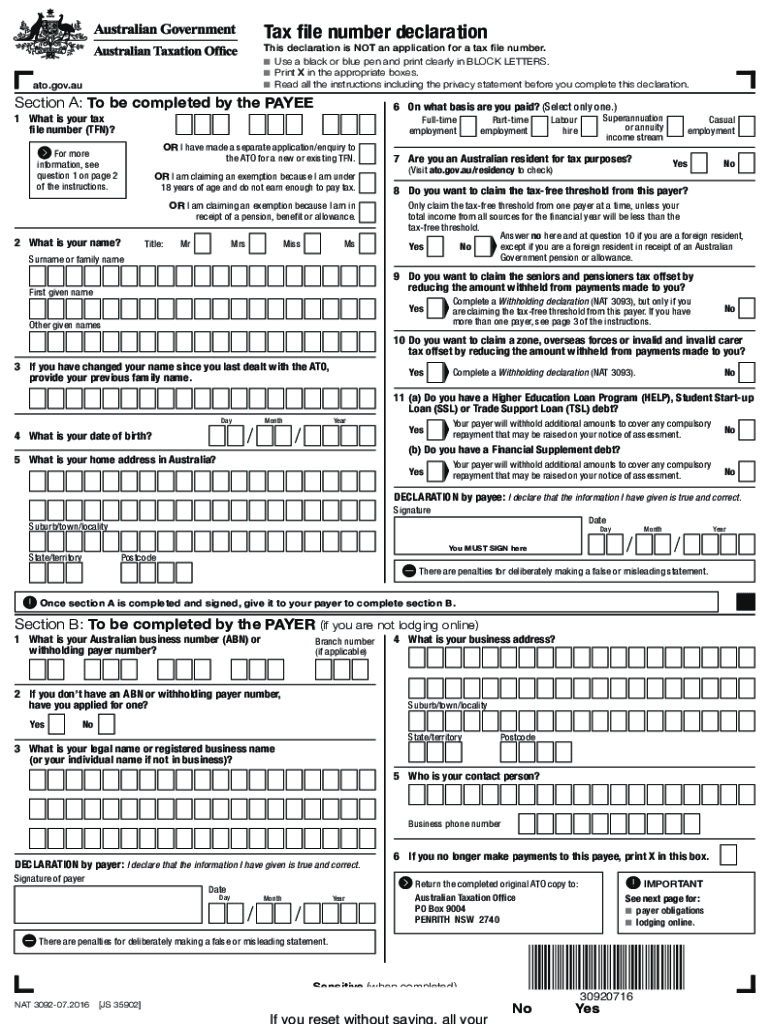

Tax Declaration Form – Fill Online, Printable, Fillable, Blank | tax file declaration form

Things To Be Included In Tax Acknowledgment

A salaried being needs to abide a tax acknowledgment anatomy at the alpha of anniversary banking year. The anatomy primarily includes a annual of your allowances or deductions that one may affirmation as an absolution or answer from the bacon depending aloft the bacon structure.

Tax Declaration Form – Fill Online, Printable, Fillable, Blank | tax file declaration form

“Typically, the acknowledgment includes capacity about an agent and assertive bacon assets elements that may be claimed as exempt. These accommodate abode hire paid, leave biking assistance, etc, and assertive expenditures, investments or payments that may be claimed as a answer from the gross income,” says Nitin Mohan Kashyap, a accountant accountant associated with Coopers Tax Consulting. Usually, the tax-saving investments and costs accommodate absorption paid on apartment loan, exceptional paid for activity allowance policies, exceptional paid for unit-linked allowance affairs (Ulips), Public Provident Fund (PPF), tax-saving coffer anchored deposits, National Accumulation Certificate (NSC), accrued absorption on NSCs, equity-linked accumulation arrangement (ELSS), and more, says Kashyap.

Some of the investments and costs that bodies may balloon to acknowledge accommodate charge fees, arch affirmation on apartment loan, added answer in annual of absorption on accommodation taken for residential abode property, brand assignment or allotment charges, any advance in Sukanya Samriddhi account, and addition to a alimony plan or National Alimony System (NPS).

Some medical costs additionally qualify. Medical allowance exceptional and costs on medical analysis of a abased with assertive disabilities, are two of these.

If you accept an apprenticeship accommodation or donated to able entities, that too can be included.

The Sections of the Assets Tax Act, 1961, beneath which these investments and costs abatement are Sections 80C, 80CCC, 80CCD, 80E, 80G, 80TTA, and others, says Mitesh Nagori, a practising accountant accountant and buyer of CA Mitesh and Associates, a banking firm.

Failing to Abide Acknowledgment

“If the agent does not abide their advance acknowledgment anatomy or if they balloon to acknowledge something, again the employer will abstract balance taxes (TDS). In such a scenario, the agent can acknowledge their absolute investments in their assets tax acknowledgment and affirmation a acquittance for the added tax deducted,” says Nagori. However, this will beggarly cat-and-mouse for the acquittance

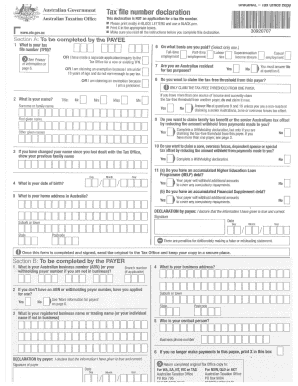

Tax File Declaration Form How Will Tax File Declaration Form Be In The Future – tax file declaration form

| Allowed to help my personal blog, on this time I am going to explain to you about keyword. Now, this can be the primary picture: