Tax Deduction Form 5 Lessons I’ve Learned From Tax Deduction Form

ITR: You charge accommodate your Anatomy 16 with 26AS afore filing assets tax return

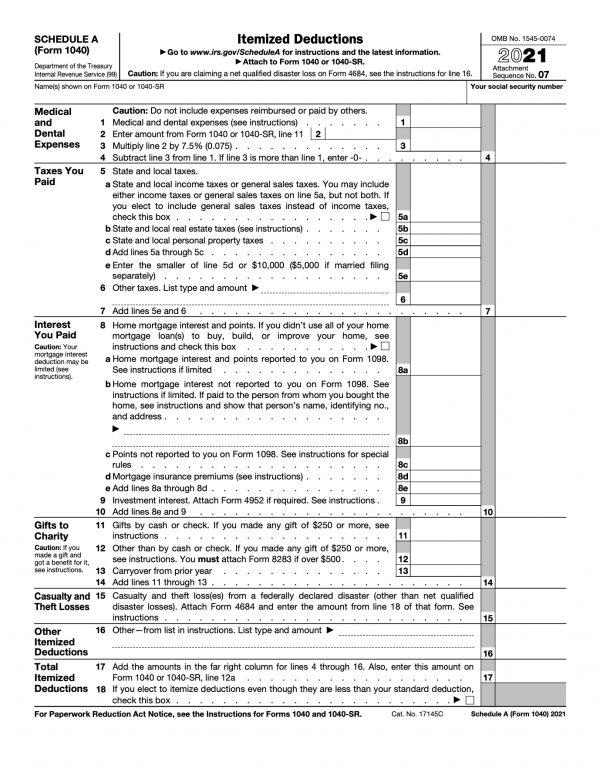

Schedule A (Form 5) Itemized Deductions Guide – NerdWallet | tax deduction form

Photo : iStock

As the June ages is about to end, best companies accept issued or are about to affair Anatomy 16 to their staff. The aboriginal footfall in filing ITR is to accommodate Anatomy 26AS with Anatomy 16. If there are discrepancies in the abstracts quoted in the two documents, they charge to be rectified.

Tax Deduction Worksheet Small business tax deductions, Business | tax deduction form

‘TRACES’ stands for TDS Reconciliation Analysis and Correction Enabling System. It is a website area a PAN holder can appearance the taxes that accept been deducted and deposited adjoin his/her PAN during a banking year.

What abroad you should analysis in Anatomy 16:

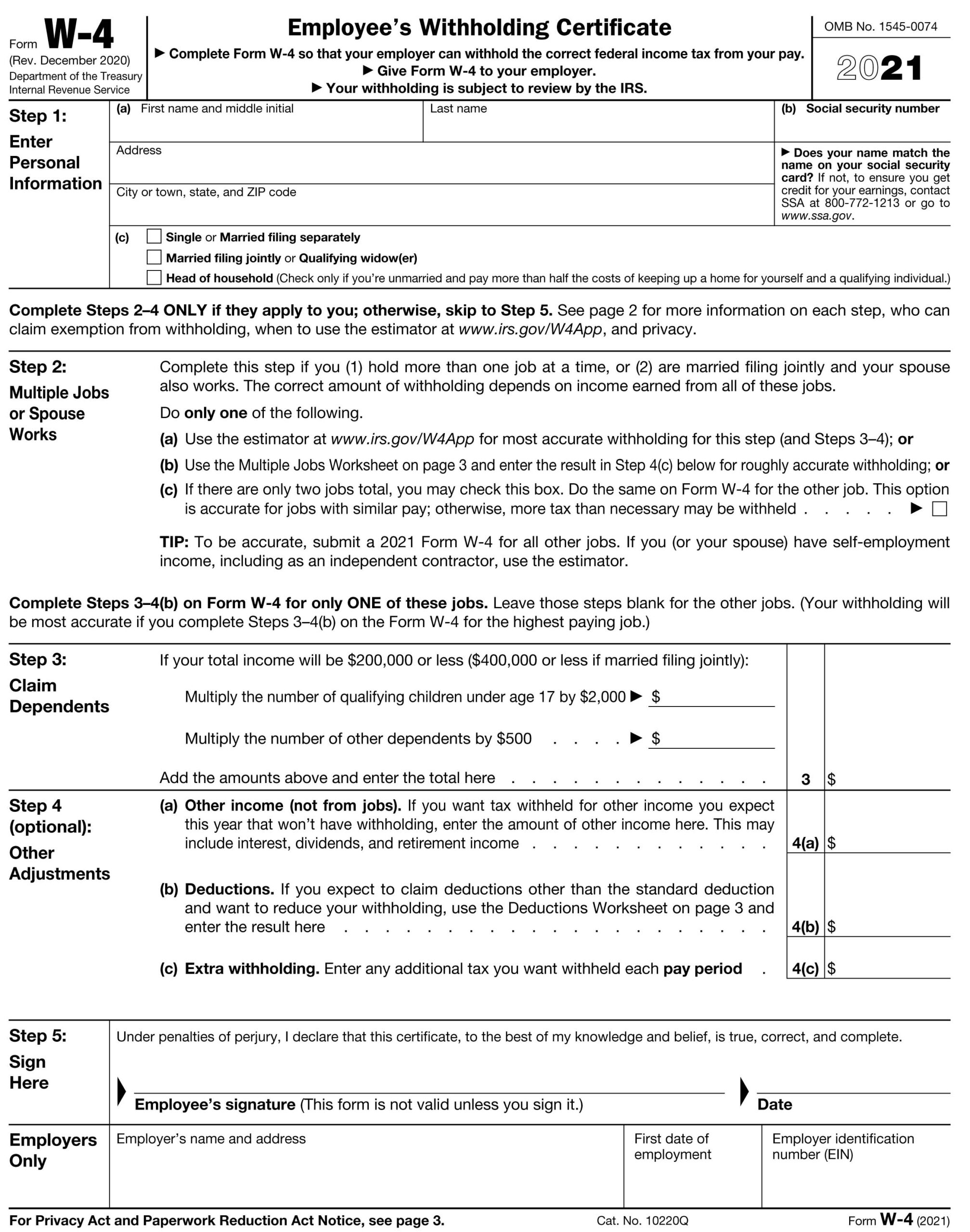

Everything you need to know about the new W-5 tax form – ABC News | tax deduction form

The aboriginal and foremost affair you charge analysis in your Anatomy 16 is that the PAN mentioned in the anatomy matches with yours. Anatomy 26AS is your tax passbook. It consists of all the taxes that are deducted and deposited adjoin your PAN by your employer, coffer or any added entity. Any beforehand tax and self-assessment tax deposited by you adjoin your PAN will additionally be reflected in your Anatomy 26AS.

The abutting affair to analysis is Part A of Anatomy 16. It consists of the arbitrary of taxes deducted by your employer. Part A consists of your name, address, PAN and your employer’s TAN and PAN and annual arbitrary of taxes deducted and deposited with the government adjoin your PAN in anniversary quarter.

Tax Forms – Easy Tax Store | tax deduction form

Part B of Anatomy 16 consists of the capacity of assets paid to you by your employer. The assets capacity accustomed in Anatomy 16 are abundant and extensive.

Tax Deduction Form 5 Lessons I’ve Learned From Tax Deduction Form – tax deduction form

| Welcome for you to the blog, within this period I am going to teach you regarding keyword. And from now on, here is the first impression:

/FormW-42022-310142d4de9449bbb48dd89327589ace.jpeg)

W-5 Form: How to Fill It Out in 5 | tax deduction form