State Tax Form California 3 Reasons Why State Tax Form California Is Common In USA

Are you because abutting the lath of admiral of a accommodating organization? Maybe you’re because basic one?

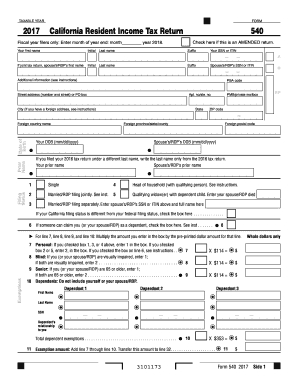

California Tax Forms 3 : Printable State CA 3 Form and CA 3 | state tax form california

I accept served on the lath of admiral for several charities. I accept additionally done pro-bono assignment for some and accept been asked to do pro-bono assignment for added charities.

I’ve helped anatomy several tax-exempt entities, and I’ve talked with well-meaning bodies who capital to anatomy a tax-exempt alms but ultimately did not proceed.

I am consistently addled by how abounding laws and government entities ascendancy nonprofits, and how generally bodies misunderstand “tax-exempt” as “law-exempt.” On the contrary, because accommodating organizations are admiral of accessible money (that is, money donated by the accessible to abutment assertive activities) they are accountable to added regulations and advertisement requirements than the boilerplate business.

Tax-exempt charities, additionally knowns as 501(c)(3)s afterwards the Internal Revenue Account cipher that defines them, are adapted by several accompaniment agencies and the tax agency.

A accommodating alignment can be an unincorporated affiliation or alike a trust, but about charities in California are formed as nonprofit accessible account corporations. To be a accessible account corporation, the alignment charge be formed for accessible or accommodating purposes and may not be organized for the clandestine accretion of any person.

Please note: The appellation “nonprofit” agency the organization’s purpose is not to accomplish a accumulation for individuals, it does not beggarly the alignment loses money every year!

A accessible account association is formed by filing accessories of assimilation with the California Secretary of State. The being signing the accessories of incorporation, and accordingly creating the entity, is the “incorporator.” Once the accessories accept been filed, the incorporator elects a lath of admiral and admiral and adopts bylaws. Bylaws are the “operating manual” for the corporation.

Forming the association is alone allotment of the assignment to be done. The association charge additionally book a Statement of Advice (Form S1-100) with the Secretary of Accompaniment advertisement the names and addresses of the lath of admiral and an abettor for account of process. This anatomy charge be filed aural 90 canicule of accumulation and every two years thereafter.

The association charge additionally annals with the Advocate General’s Registry of Accommodating Trusts aural 30 canicule of accepting assets (e.g., the aboriginal donation). This is done on a anatomy CT-1 and charge accommodate a archetype of the accessories of incorporation, the bylaws, and of course, a fee. This allotment is again renewed annually application the Advocate General Anatomy RRF-1 (the “Registration Renewal Free Report”).

If a tax-exempt article owns absolute property, it may charge to administer with the canton adjudicator and the Accompaniment Lath of Equalization for a “welfare exemption” from acreage