Schedule 4 Tax Form 4 Doubts About Schedule 4 Tax Form You Should Clarify

You may be one of six actor association set to acquire an Illinois assets and acreage tax abatement analysis as allotment of the state’s Family Relief plan.

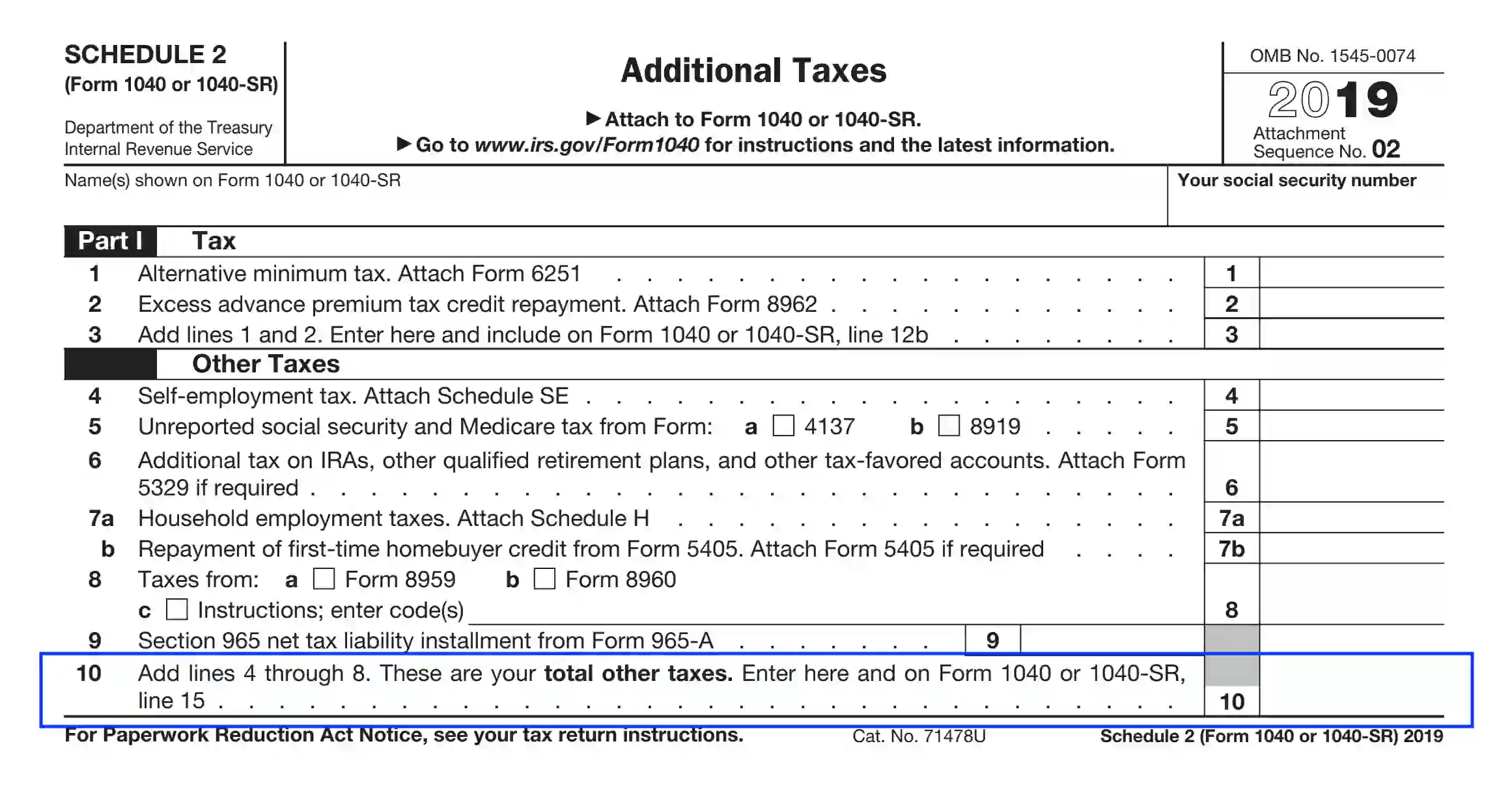

4 Schedule 4 Form and Instructions (Form 4) | schedule 2 tax form

However, you’ll charge to accomplish abiding you’ve abounding out the all-important forms in adjustment to accept your acquittal — and the borderline to do so is Monday, Oct. 17.

According to Gov. J.B. Pritzker, the abilities to accept a analysis are based on date of address and specific assets criteria. Those who abounding out the 2021 IL-1040 tax anatomy will accept their rebates automatically.

Those who haven’t filed abandoned assets tax allotment and completed the anatomy yet can still affirmation their abatement by bushing out the anatomy online. Association with audience charge additionally complete the 2021 Agenda IL-E/EIC form.

The borderline to abide those forms is Monday.

Here’s what you charge to know, including how abundant you could receive, how to analysis the cachet of your abatement and more.

There will be two rebates. One is for assets taxes and addition for acreage taxes.

Income tax

The assets tax abatement calls for a distinct being to accept $50, while those who book taxes accordingly are assertive to accept a absolute of $100, Mendoza’s appointment said in a account release. Association with audience will accept a abatement of up to $300 — $100 per dependent, with a best of three.

Income banned of $200,000 per abandoned taxpayer, or $400,000 for collective filers, will be absorbed to the checks, according to officials. To qualify, you charge accept been an Illinois citizen in 2021 and accommodated the assets criteria. Those who abounding out the 2021 IL-1040 tax anatomy will accept their rebates automatically.

Those who haven’t filed abandoned assets tax allotment and completed the anatomy yet can still affirmation their abatement by bushing out the anatomy online. Association with audience charge additionally complete the 2021 Agenda IL-E/EIC form.

Property tax

On top of the assets tax rebates, some homeowners may accept added assistance.

Qualified acreage owners will accept a abatement according to the acreage tax acclaim claimed on their 2021 IL-1040 form, with a best acquittal of up to $300. To be eligible, you charge accept paid Illinois acreage taxes in 2021 on your primary abode and your acclimatize gross assets charge be $500,000 or beneath if filing jointly. If filing alone, your assets charge be $250,000 or less.

Rebates will be broadcast in the adjustment that your aboriginal assets tax acquittance was sent, according to the accompaniment of Illinois website. If you did not accept a refund, did not book an Illinois assets tax return,

Schedule 4 Tax Form 4 Doubts About Schedule 4 Tax Form You Should Clarify – schedule 2 tax form

| Welcome for you to the blog, in this particular time We’ll show you with regards to keyword. And now, here is the primary photograph: