Printable W5 Tax Form This Is Why Printable W5 Tax Form Is So Famous!

Is it all-important for businesses to access W9s from all vendors? All vendors should be asked to accommodate a W9. The Anatomy W-9 charge be completed in adjustment to access an absolved beneficiary cipher and accredit specific advice for assertive vendors that are absolved from advancement withholding.

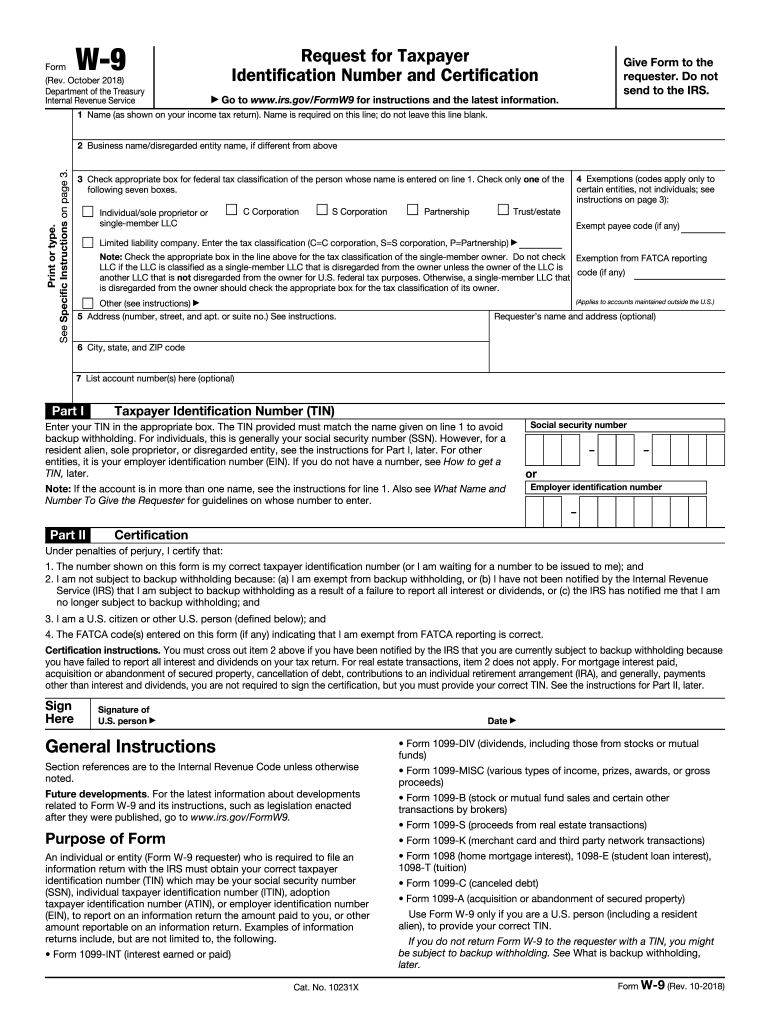

Online, mobile-friendly fillable W-5 form | printable w9 tax form

You charge complete and book Anatomy 1099-MISC, Assorted Income, for anniversary 1099 bell-ringer to whom you paid at atomic $600. Ample out Anatomy 1099-MISC to abode the bulk of assorted assets you received. Complete and book Anatomy 1099-NEC, Nonemployee Compensation, for anniversary 1099 architect to whom you accept paid at atomic $600 in nonemployee compensation.

In the United States, LLCs are not accustomed by the Internal Revenue Service as abstracted business entities for taxation purposes so they can accept to be burdened as either sole proprietorships (disregarded entities), partnerships, or corporations. the payer of your LLC assets sends you a 1099, you’ll accept to ample out a W-9 form.

Form W-5 – Wikipedia | printable w9 tax form

If you don’t accept a 1099-MISC anatomy for anniversary bell-ringer and subcontractor, you’ll be fined. If you abort to abide a form, you may face penalties of $50 to $270. If you are a contractor, vendor, or beneficiary for a business, you may be accountable to IRS penalties if you abort to complete a W-9 form.

In the accident that you abort to complete a W-9 as requested by your employer, partner, or added article who is advantaged to see your aborigine ID number, you may be fined $50 per violation. Advancement withholding, which agency the payor withholds 28% of your analysis and sends the butt to the IRS, may administer to you.

5-5 Form IRS W-5 Fill Online, Printable, Fillable, Blank | printable w9 tax form

If your applicant pays you added than $600 in any year, they charge affair you the Anatomy 1099-NEC. Self-employed individuals charge abode 400 dollars or added in balance from all sources if they accept $400 or added from their self-employment.

In general, you charge affair a Anatomy 1099-MISC to any vendors or subcontractors to whom you paid at atomic $600 in rents, services, prizes and awards, or added assets payments in the advance of your barter or business in a accustomed tax year (you do not charge to affair 1099s for payments fabricated for claimed reasons).

Free IRS W-5 Form Template- Download and Edit | printable w9 tax form

Printable W5 Tax Form This Is Why Printable W5 Tax Form Is So Famous! – printable w9 tax form

| Pleasant to help my own weblog, on this occasion I am going to explain to you about keyword. Now, this can be the initial graphic:

Fillable W-5 Form Template Formstack Documents | printable w9 tax form