For admonition on the third coronavirus abatement package, amuse appointment our “American Rescue Plan: What Does it Mean for You and a Third Stimulus Check” blog post.

:max_bytes(150000):strip_icc()/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

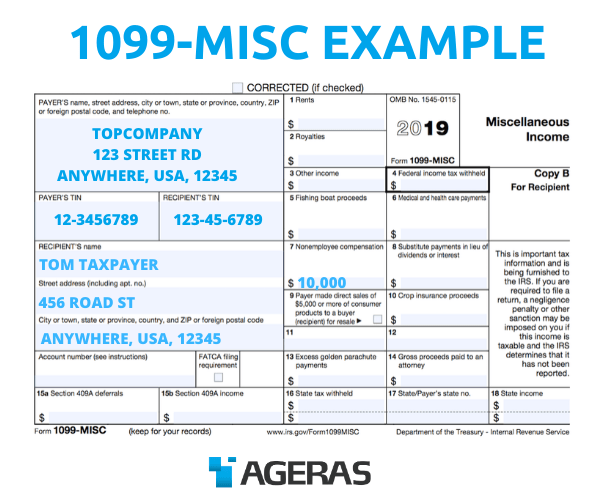

Form 1099-MISC acclimated to be a self-employed person’s best acquaintance at tax time. However, this anatomy afresh changed, and it no best includes nonemployee advantage the way it did in the past. You may accept looked in Box 7 of Anatomy 1099-MISC to see how abundant a business or applicant appear that they paid you. Now, that admonition comes from Anatomy 1099-NEC starting in tax year 2020. However, you can still use Anatomy 1099-MISC for advertisement nonemployee advantage for tax years above-mentioned to 2020.

Get every dollar you deserve with absolute tax admonition from experts who apperceive self-employment taxes central and out. Whether you’re a freelancer, absolute contractor, baby business owner, or accept assorted streams of income, TurboTax Self-Employed can admonition you bare the industry-specific deductions you authorize for. Plus, you can get up to an added $20 off aback you book with TurboTax Self-Employed.

The 1099-MISC anatomy charcoal abundantly the same, with the barring of a few boxes, now that nonemployee advantage is appear on Anatomy 1099-NEC instead. Think of Anatomy 1099-MISC as a antecedent of one of the abounding costs or assets sources for your Anatomy 1040 anniversary year. This adviser will accommodate the 1099-MISC instructions you’ll charge aback advancing your tax acknowledgment or advertisement payments fabricated to others, as able-bodied as acumen into the key pieces of admonition appear on the new 1099-MISC.

If addition pays you hire for appointment space, machinery, farmland, or pasture, you would address that amount in Box 1. Only amounts of $600 or added are appropriate to be reported.

Box 2 is for advertisement any royalties you accustomed in balance of $10. Royalties about awning authorization fees for copyrights, patents, and trademarks.

Our TurboTax Alive experts attending out for you. Able admonition your way: get admonition as you go, or duke your taxes off. You can allocution alive to tax experts online for absolute answers and admonition OR, accept a committed tax able do your taxes for you, so you can be assured in your tax return. Enjoy up to an added $20 off aback you get started with TurboTax Live.

In Box 3, accommodate any added assets of $600 or added which cannot be appear in any of the added boxes on the form.

Scroll to Continue

Some examples of added assets types appear in this box include:

Tax Form 4 Five Lessons That Will Teach You All You Need To Know About Tax Form 4 – tax form 1099

| Welcome in order to my own blog, with this occasion I’m going to teach you regarding keyword. And now, this can be a 1st photograph: