Joint Tax Return Form Five Things You Probably Didn’t Know About Joint Tax Return Form

Image source: Getty Images

Joint Tax Return – Fill Online, Printable, Fillable, Blank pdfFiller | joint tax return form

Many affiliated couples aggregation up on a business adventure after acumen they’ve formed a partnership. Some anatomy bound accountability companies (LLCs) for the acknowledged protections, blind that these entities are additionally burdened as partnerships at the federal level. At tax time, they aloof address their assets on a collective Anatomy 1040, attach a Schedule C, and get aback to work.

Yet beneath federal tax laws, these baby ancestors businesses charge book affiliation tax returns. That wouldn’t be a big deal, except that it adds about 270 hours’ annual of paperwork and $4,400 in able fees to their anniversary tax filings by Internal Revenue Account (IRS) estimates.

Husband-wife partnerships may afford that accountability by electing to be burdened as a able collective adventure (QJV) instead of a partnership. Acquisition out whether a QJV makes faculty for your business.

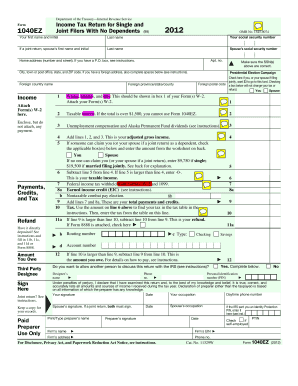

Learn How to Fill the Form 5EZ Income Tax Return for Single and Joint Filers With No Dependents | joint tax return form

A able collective adventure is a federal tax cachet affiliated couples may accept if they run a business together. To qualify, your business charge accommodated these criteria:

To authorize as a QJV, your affiliated affiliation charge be a aggregate business or trade. Collective buying of acreage abandoned doesn’t authorize for QJV treatment.

Typical Baby Business Tax Accountability for Able Collective Ventures vs. Partnerships

How to Fill Out Your Tax Return Like a Pro – The New York Times | joint tax return form

Qualified collective ventures accept abundant beneath tax paperwork to book anniversary year than partnerships.

You can accept able collective adventure cachet on your anniversary tax acknowledgment by filing a collective IRS Anatomy 1040 and adhering a abstracted tax Schedule C for anniversary spouse, forth with abstracted added schedules such as Schedule SE as required.

If you run a rental absolute acreage business, you charge book a collective Schedule E and assay the “QJV” box on band two. Unlike the added schedules for the QJV, you do not book assorted Schedule E tax forms.

Joint Tax Returns in Divorce Must I File Jointly Effect of | joint tax return form

As a able collective venture, you’re actuality burdened as two sole proprietors. Sole proprietorships are simple to administer because they are abandoned entities, acceptation they charge not book abstracted tax allotment for the business.

That makes your QJV tax acknowledgment almost simple and

Joint Tax Return Form Five Things You Probably Didn’t Know About Joint Tax Return Form – joint tax return form

| Welcome to my personal weblog, with this time period We’ll explain to you with regards to keyword. And today, this can be the 1st image:

How to Fill Out Your Tax Return Like a Pro – The New York Times | joint tax return form