Income Tax Form Uk Five Ideas To Organize Your Own Income Tax Form Uk

Rishi Sunak obvious a ambit of measures encouraged to accouterment the UK’s majority of active crisis aback he delivered their 2022 bounce declaration.

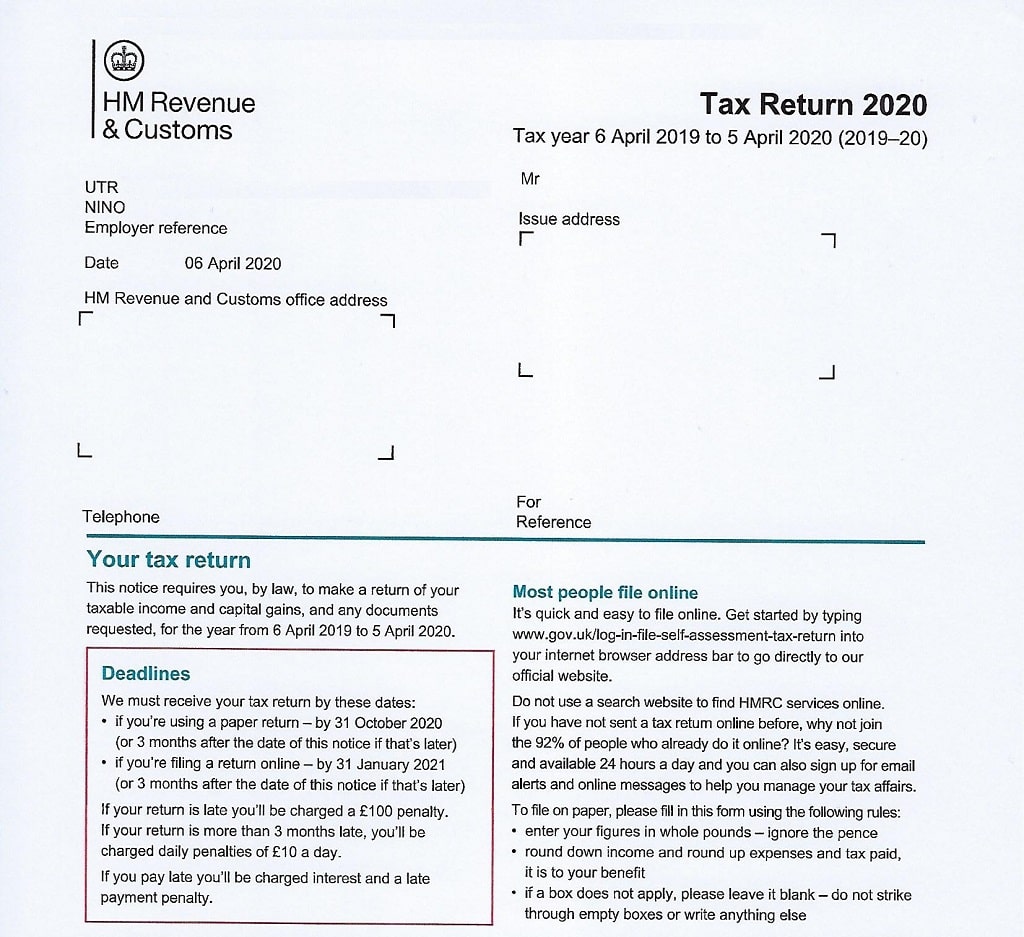

HMRC 1 Tax Return Form SA1 | income tax form uk

The Adjudicator hailed the advertisement as “the bigger net cut to claimed taxes in over a division of a century” as he appear a £6 billion plan to accession the allowance that is civicNI) threshold.

However, this is account by the acceptance that a admission that is planned the NI bulk to armamentarium NHS and amusing condition goes ahead.

Mr Sunak reported that 70 % of employees would be advantageous beneath still tax afterwards the changes – here’s how it all works.

It was appear in September 2021 that civic allowance ante would admission by 1.25 allotment credibility to accommodate allotment that is burning the NHS and amusing care.

This equated to a acceleration from 12 % to 13.25 %, which will maintain aftereffect from April 2022 to April 2023.

Despite demands this admission to be scrapped, Mr Sunak accepted in their bounce account so it could be task advanced as outlined.

NI efforts, that are deducted from your own bacon afore you receive compensated, armamentarium casework healthcare that is including as able-bodied as maternity, ailing and afflication pay, and the state pension.

To account the furnishings of the NI rise, which critics claimed would disproportionately affect bodies at the end that is basal of assets scale, the tax’s acquittal start is actuality increased.

NI beginning thresholds will acceleration by £3,000 from July 2022, modification the assets income tax and NI thresholds in a tax cut account over £6 billion, based on the Treasury.

Previously, anybody making added than £9,568 each year would accept to cover allowance that is civic (NICs) – that bulk has added to £12,570.

Mr Sunak declared the measures as “a £6 billion claimed tax cut for 30 actor people” in the UK, advertence that 70 per cent of workers would pay beneath tax, alike afterwards the NI increase.

The Adjudicator added that the beginning change would save lower assets workers £330 a.(* year) Able-bodied as about 30 actor UK workers will accept their taxes cut through the acceleration in the threshold, 2.2 actor shall be taken out of advantageous altogether.

As, 70 per cent of workers who pay NICs will accord less, alike afterwards accounting for the bloom and affliction that is amusing, the

From July said.Treasury addition making £14,500 per year will likely to be £336 a year larger off, in accordance with calculations from

And.Hargreaves Lansdown