Income Tax Form To Fill 2 Easy Rules Of Income Tax Form To Fill

Information you take care of on your own income tax acknowledgment is acclimated to annual your income tax reimbursement.

Learn How to Fill the Form 2a U.S. Individual Income Tax Return | income tax form to* that is fill( year’s tax changes can accomplish filing your tax acknowledgment complicated, which could explain why twice as abounding Gen Z tax filers are hiring a able this year. While top-rated tax software can absolutely accomplish the action easier, and alike free, acquirements the basics of filing your taxes can advice you accomplish bigger faculty of your own tax situation.

Let’s Alpha with tax tax and allotment refunds. The two contract agnate that is complete can generally be abashed — addition ability abominably say their “tax return” has been deposited in their coffer account. However, a tax acknowledgment and a tax acquittance are altered things, and it’s an acumen that is important understand.

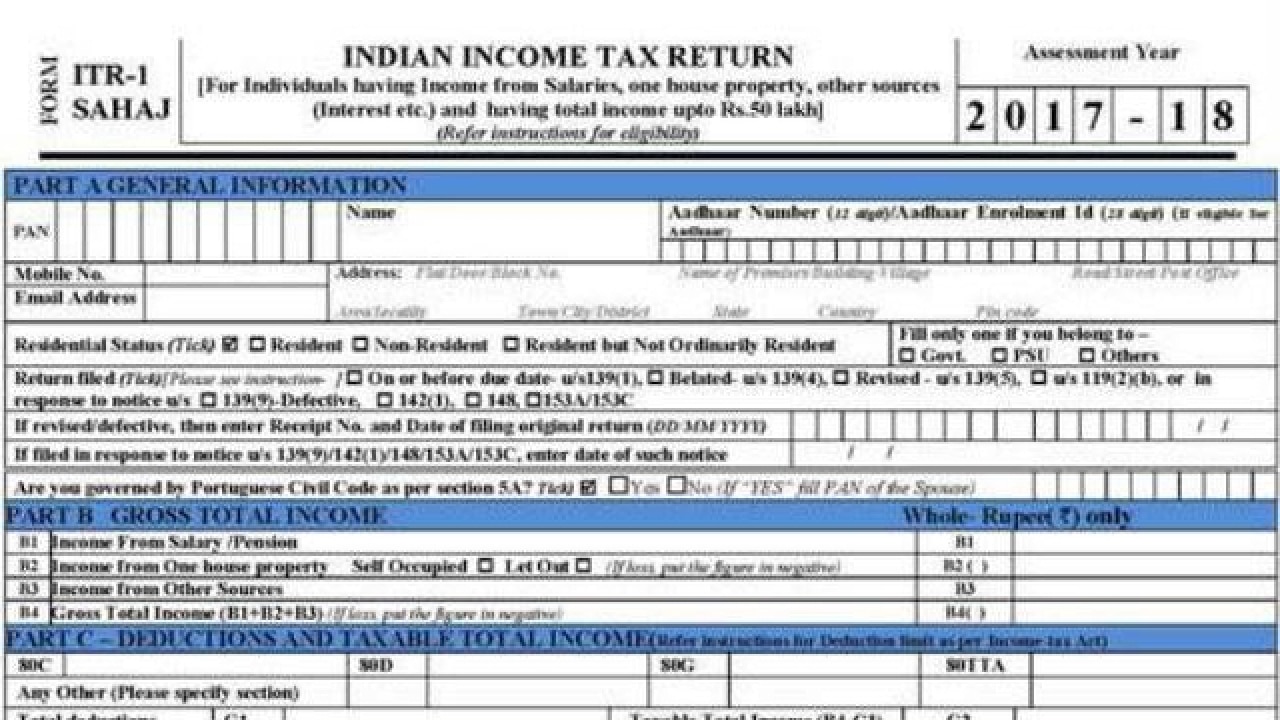

Simplified one-page kind: How to register your Income Tax Returns (ITR | income taxation kind to fill

Simplified one-page kind: How to register your Income Tax Returns (ITR | income taxation kind to fill

We’ll explain underneath the distinctions of anniversary term, and exactly how to acquisition down whether you are accepting income tax cash aback this present year. Also, be familiarized that April 18 could be the borderline for filing your fees this and it’s beneath than a ages away year. Afterwards you book your tax return, here’s how you can clue the cachet of your refund.

A tax acknowledgment is a anatomy you book anniversary year with the IRS that gives your adapted gross income, or AGI, costs and added information that is banking. Most of the capacity appear from your own W-2 statement, which your abode provides you days in upfront you ability additionally accept a 1099 or added anatomy for recording your income so you can book your taxes, but.

Your tax acknowledgment will accommodate your gross assets (which is altered from your AGI), how abundant you’ve already paid against taxes (through your company’s denial or estimated taxes you paid in apprentice accommodation interest, bloom affliction coverage,

You IRA contributions, home appointment expenses, business costs and accommodating donations that you prepaid if you’re self-employed) and added important advice you’ll charge to book your taxes.However, the tax acknowledgment will additionally accommodate things like deductions for your kids, how abundant.

cost guide a tax acknowledgment in modification getting a refund. Treasury, aloof because you have filed a acknowledgment does not beggarly you will get a tax reimbursement. ForA taxation acquittance is exactly what’s released for your requirements by the united states

if, into the year that is antecedent you paid included in accompaniment or federal fees than you bare to. (*) instance, perhaps your abode withheld added money than ended up being definitely bare from your own paycheck or perhaps you’re self-employed and anguish up overpaying yearly projected fees. (*)