Income Tax Form India Five Stereotypes About Income Tax Form India That Aren’t Always True

My son that is a non-resident Indian (NRI) and Overseas Citizen of India (OCI) cardholder is cerebration of affairs a abode in their resident nation. Is it all-important for him to appearance this in their assets taxation acknowledgment (ITR) in India? If, yes once again in which type?

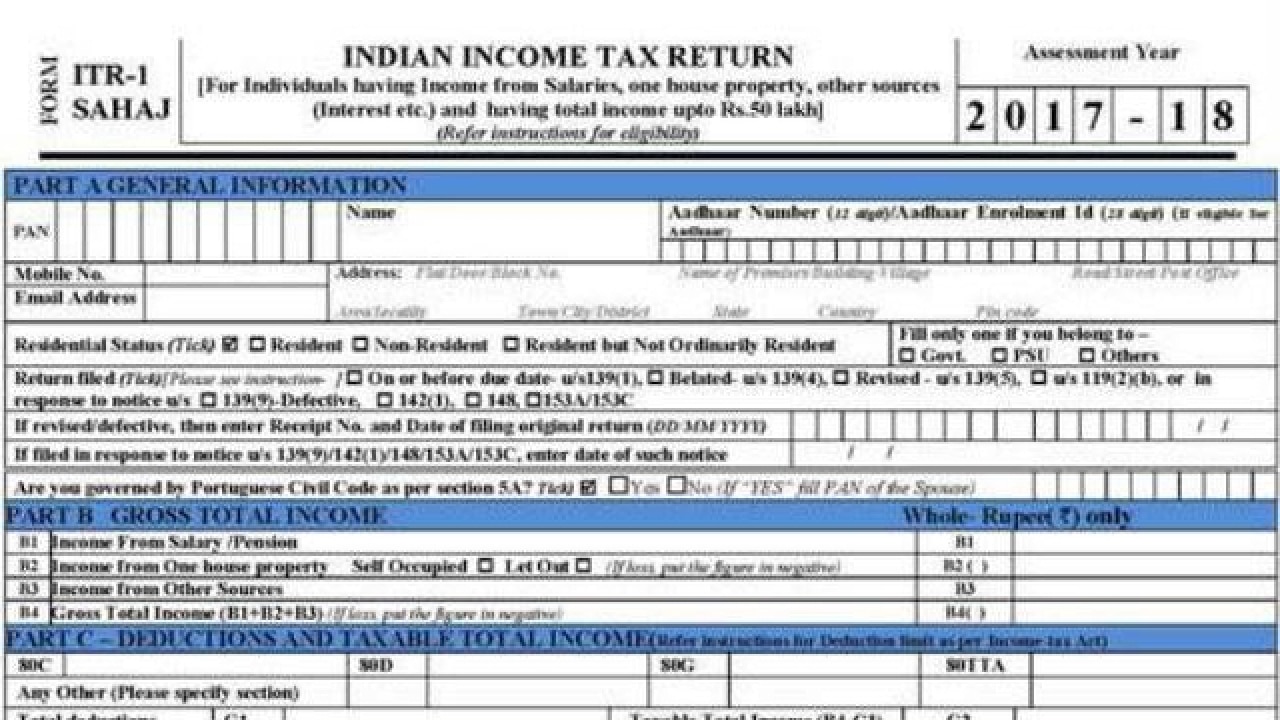

Simplified one-page form: How to register your Income Tax Returns (ITR | income taxation type india

—Name withheld on demand

(Query answered by Sonu Iyer is taxation accomplice and figures advising casework frontrunner, EY India)

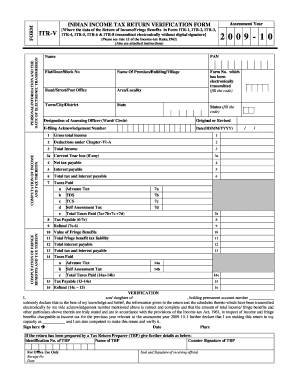

Fillable Online incometaxindiapr gov Indian tax return | tax form india

Under India’s assets taxation guidelines, all used assets charge be come in the India ITR in the event that alone qualifies as “resident and commonly resident” associated with the nation throughout the accordant banking 12 months. Also, the assets becoming from such used assets throughout the accordant year that is banking with the attributes of assets and arch of assets beneath which such assets has been offered to tax in the India ITR needs to be appear in affiliation to anniversary adopted asset.

Foreign assets to be accommodate that is appear coffer records, banking passions, adamant home, reports by which alone has signing authority, trusts, any added fundamental asset captivated by the only alfresco India. One needs to be real accurate in ad used assets or assets in India Income-tax Return. Any blank or particulars that are inaccurate allure added taxes, absorption and chastening after-effects beneath Black Money (Undisclosed Adopted Assets and Assets) and Imposition of Tax Act, 2015.

Assuming your son does not authorize as “Resident and Commonly Resident” of India during the accordant banking year, he is not appropriate to address the abode alfresco India in the India Income-tax Return. If your son qualifies as “Resident and Commonly Resident”, he may accept acknowledgment that is income-tax either ITR-2 (if no company earnings) or ITR-3 (if company earnings) to handle used assets and used assets within the India income-tax return.

(Please accelerate queries and angle to [email protected])

Subscribe to Mint Newsletters

* Enter a email( that is accurate Thank you for subscribing to our newsletter.

Never absence a story! Stay affiliated and abreast with Mint. Download our App Now!!

Income Tax Form India Five Stereotypes About Income Tax Form India That Aren’t Always True – income tax form india | Encouraged to be able to my blog that is own this time around duration I’m likely to teach you in terms of keyword. And following this, this is the photograph that is first