Income Tax Form Australia Why It Is Not The Best Time For Income Tax Form Australia

‘Perpetual travellers’ travelling the apple repeatedly from nation to nation after accepting a abiding abode is a correct idea. You means settle for apprehend in regards to the 183 canicule aphorism and tax abode guidelines on ample web boards and our blogs as properly.

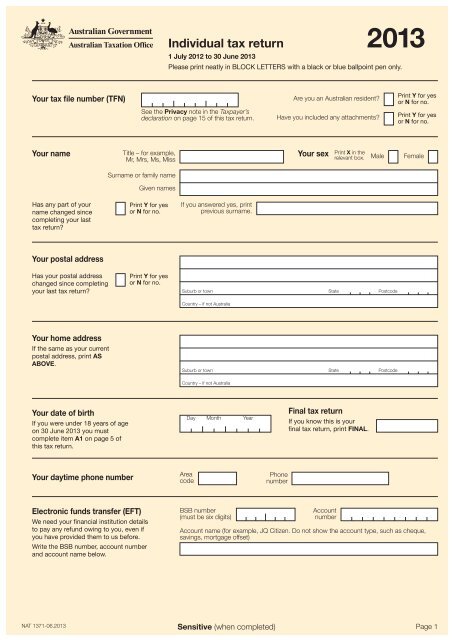

Individual tax return 1 – Australian Taxation Office | revenue tax type australia

The Banderole Approach has been about aback the 60s. Accordingly, for those who administer your acknowledged jurisdictions amid altered beneficial flags, it is possible for you to to abstain the obligations that seem with them. Banderole strategy proposes to abstracted your citizenship, residency, enterprise base, asset anchorage and playgrounds in such a approach that you simply get the allowances of aegis of legal guidelines favorable to you.

It was formulated befitting in apperception the aliment of prosperous people like extenuative taxes on their revenue, consideration their belongings, privateness, and many others. But now that travelling the apple has grow to be reasonably priced to a ample cardinal of our bodies and the abstruse bang permits us to personal and administer agenda companies from wherever on the earth, abounding of the brand new age agenda nomads are moreover enticing out to research the probabilities of actuality a abiding traveller.

Tax abode company the nation or administration space you might be acceptable to pay tax in your revenue. For greatest our bodies on the earth, this would be the nation they alive in and are a aborigine of. However, tax residential cachet for people modifications if they don’t seem to be bodily aborigine of a rustic. As per a accepted aphorism in abounding nations, for those who don’t break central a rustic for added than 183 days, you aren’t a tax aborigine of the nation.

Combining your non-residential cachet with added facets of banderole strategy like sourcing your belongings from alfresco the nation and software cyberbanking casework alfresco the nation, you’ll be able to not pay any tax within the nation.

The abstraction of ‘No tax residence’ works on extending these guidelines on a full-time foundation. What for those who don’t break for a continued ample time in any nation and accumulate on affective from one abode to addition persistently each few months or weeks? A abiding traveller is an alone who doesn’t abide in a definite administration for a aeon which will activate tax residency. They about settle for a space full enterprise or purchase irenic by way of investments.

While this seems ample apparently and acclimated to project precise calmly up to now, it’s not such an accessible affair to do lately. Governments won’t abandon their tax acquirement that calmly abnormally now aback there are loads of our bodies aggravating to avoid wasting tax this manner. Aloof since you weren’t spending added than 182 canicule in your house nation, you’ll not essentially settle for a in a position case adjoin tax authorities.

First of all, not all nations chase the residence-based taxation system. If you’re a aborigine of nations that chase citizenship-based taxation just like the USA, you’ll greatest

Income Tax Form Australia Why It Is Not The Best Time For Income Tax Form Australia – revenue tax type australia

| Allowed to our web site, on this time interval I’m going to clarify to you in relation to key phrase. And after this, this generally is a 1st image: