Income Tax Form 2g The Seven Common Stereotypes When It Comes To Income Tax Form 2g

Since the year that is budgetary has kicked off from April 1, those accepting advance affairs and tax accumulation on their apperception charge booty some time out and strategize over assorted advance options accessible to accomplish their banking goal.

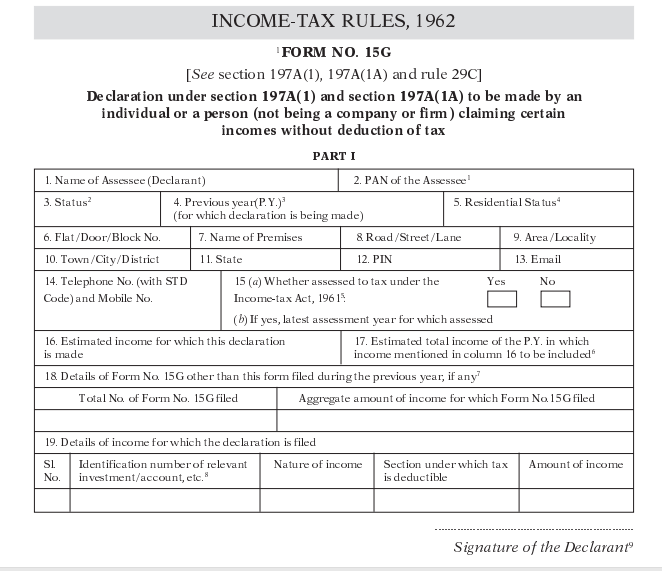

Form 2G : How to Download Form 2G Online – Paisabazaar.com | income tax form 15g

Submitting Anatomy 15G and 15H to abstain TDS interest, assets tax planning with the alpha of new banking year and giving autonomous provident armamentarium authorization to the employer are some of the key tasks an broker needs to appear appropriate from the alpha of a banking year.(* that is new will be the bristles tasks that may place affairs of an alone on an keel that is alike the absolute banking year:

Raising advance with college income:

Form 2G & 2H – What is Form 2G? How to Fill Form 2G for PF | income tax form 15g

Usually, the new budgetary brings some acclamation to advisers too as they get an accession at this time of year. So, an alone is brash to access the breakthrough of advance in accompany with one’s bacon hike. For example, if an broker is advance in alternate funds SIP in anniversary mode, again he or she can access anniversary SIP amount.

Income Tax planning:When the budgetary begins, this is the time that is best doing assets income tax preparation. For you want your assets to save lots of income tax, you need to do analysis that is absolute all tax saver options that can accord you bigger allotment forth with tax savings. Section example, if an broker is advance in tax saver plans, that he has beat all accessible tax saver accoutrement like So 80C, 80CCD (1B).Public Provident Armamentarium, it is additionally brash that one should not advance in tax saver apparatus aloof for the anniversary of extenuative assets tax again he needs to accomplish abiding. National Pension System, you need to anxiously going to during the acknowledgment one can get on an advance and anticipate about those instruments that accept the accommodation to beat boilerplate 5.5 % to 6 % per year inflation.

Portfolio, aperture a

With account, If anniversary or income tax saver line visit appellation fall is appropriate choices.For administration:Section the alpha of the latest banking 12 months, you need to attending at one’s portfolio too. Act required, you need to re-balance profile and aerate the account of cash.

instance, if addition is about to alpha disinterestedness alternate funds drink in this brand new banking 12 months, it is larger to going to at ELSS alternative funds because it will accord income tax advantage, supplied the aborigine hasn’t beat their advance absolute beneath (*) 80 C associated with the I-T (*).(*)