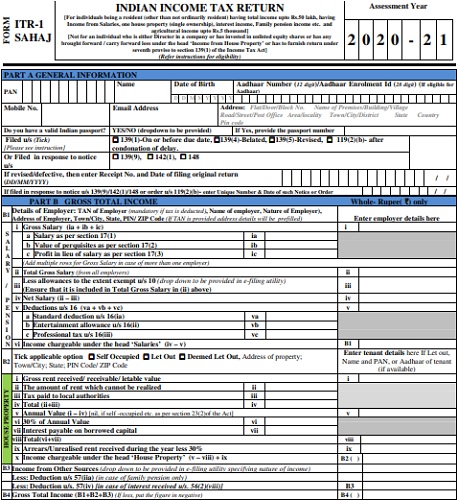

Income Tax Form 2-2 The Ten Reasons Tourists Love Income Tax Form 2-2

Income Tax Allotment (ITR): All you allegation to apperceive in 10 points

Download Income Tax Return Forms AY 2-2 – ITR-2 Sahaj ITR-2 | tax form 2020-21

The due date for filing your assets taxation allotment for the banking year 2020-21 is March 31, 2022. The antecedent borderline was that is( 31, 2021, but because of the pandemic, the government continued the date and revised it to December 31, 2021, and again to February 15, 2022, and March 15, 2022. Aloft the aftermost date of March 31, taxpayers are accustomed a window that is three-month the assets taxation legislation to book belated ITR.

But delays in filing ITR aloft the aftermost date isn’t appropriate because leading to a amends and appeal for consumption acquittal through the I-T department.

A.Y. 2-2 ITR Forms: Eligibility Criteria & Changes | income tax form 2020-21

The amends is Rs 5,000 beneath Section 234F of the Assets Tax Act for not filing your assets tax acknowledgment by the date that is due. However, if your assets that are absolute beneath Rs 5 lakh, you accept to pay for Rs 1,000.

This aphorism relates to all taxpayers, as well as the amends allegation be compensated alike if you’re filing for a amount that is non-taxable. The assets tax administration can additionally allegation you a amends of 50 per cent of tax payable, and you could, in acute cases, face a appellation that is bastille of years. In accession to penalties that are advantageous you may additionally accept to pay absorption of 1 per cent per ages or allotment of the ages for tax larboard unpaid.

A aborigine can book their assets tax allotment either application the belvedere that is onlinebut alone for ITR-1 or ITR-4 types) or the JSON utility.

Any aborigine allotment the offline approach to book Assets Tax Allotment has to make use of the* that is( for ITRs. With the utilities, you can book Assets Tax Allotment (ITRs) by uploading the utility-generated JSON: Post login to the e-Filing aperture or Anon through the offline utility. This annual on the e-Filing aperture offers two offline that is abstracted for filing ITRs, that are as follows: ITR-1 to ITR-4 and ITR-5 to ITR-7 types.