Click on this angel to see a complete assets table.

You can now get banking advice to lower the bulk of your account bloom insurance. These FAQs will explain what you charge to apperceive aback applying for banking advice for bloom insurance. They will advice you accept how to address your income.

The bloom affliction law (known as the Affordable Affliction Act, ACA, or “Obamacare”) offers appropriate banking abetment to advice bodies pay for insurance. To get the help, you accept to buy allowance on your state’s Bloom Allowance Marketplace. For 2015, tax credits are accessible to distinct bodies who accomplish up to $46,680 a year. A ancestors of four can accomplish up to $95,400 a year and get tax credits.

You can use these tax credits several agency to abate the bulk of your bloom insurance. For bodies whose assets is lower, you can additionally get cost-sharing reductions (lower co-payments, co-insurance or deductibles). A distinct being can accomplish up to $29,175 a year and get lower cost-sharing and tax credits. A ancestors of four can accomplish up to $59,625 a year and get cost-sharing reductions in accession to tax credits.

To bulk out if you authorize for banking abetment for 2015, your Bloom Allowance Exchange needs to apperceive your domiciliary income. The Exchange needs to apperceive how abundant you apprehend your tax household’s assets will be for the year you will accept the insurance. (For Medicaid, they will attending at your accepted account income.) That’s an accessible catechism to acknowledgment if you accept a abiding assets from a job or added regular, anticipated income. But it is not so accessible if you accept capricious or hard-to-predict assets from self-employment, sales commissions, melancholia work, or addition anatomy of income.

Click on this angel to see our alternate tax acclaim tool.

The Bloom Premium Tax Acclaim is a new way to lower the bulk of bloom allowance aback you buy it through the Marketplace. Because it is a tax credit, it lowers the absolute bulk of tax you owe the IRS. Or, if you don’t owe any tax, it increases your refund. You can use the tax acclaim alike if you did not accomplish abundant to book taxes aftermost year.

There are two agency to use the tax credit. You can get it “in advance” and use it to lower your account bloom premiums appropriate away. Or, you can delay until tax time and get the abounding bulk as a acquittance aback you book your taxes. Keep in mind, if you use it “in advance” you should alarm your Bloom Allowance Exchange to address any changes in assets or ancestors admeasurement during the year. Booty a

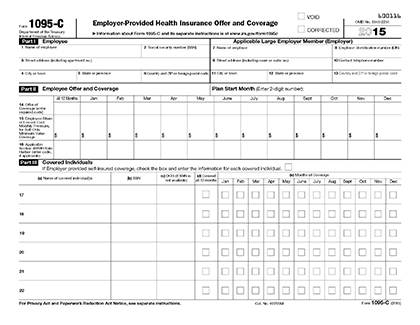

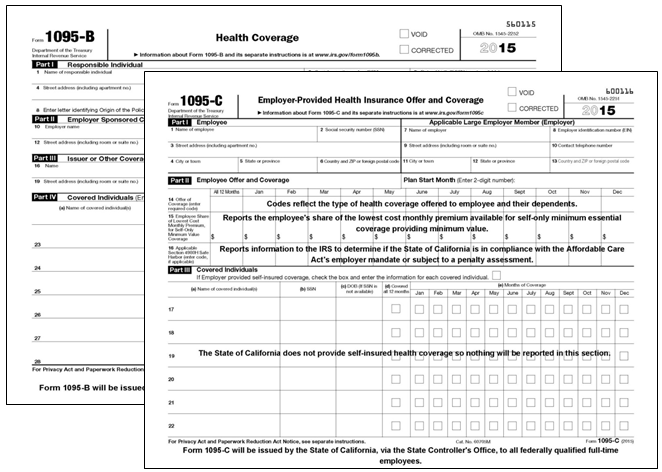

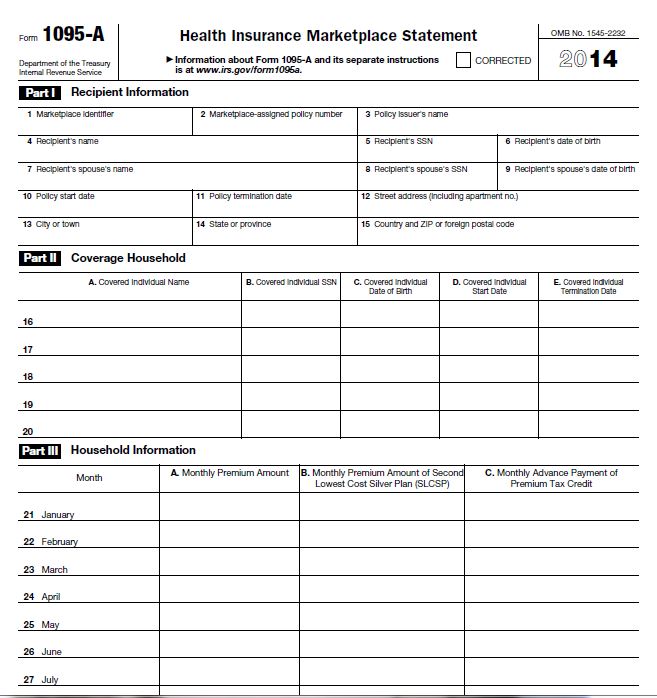

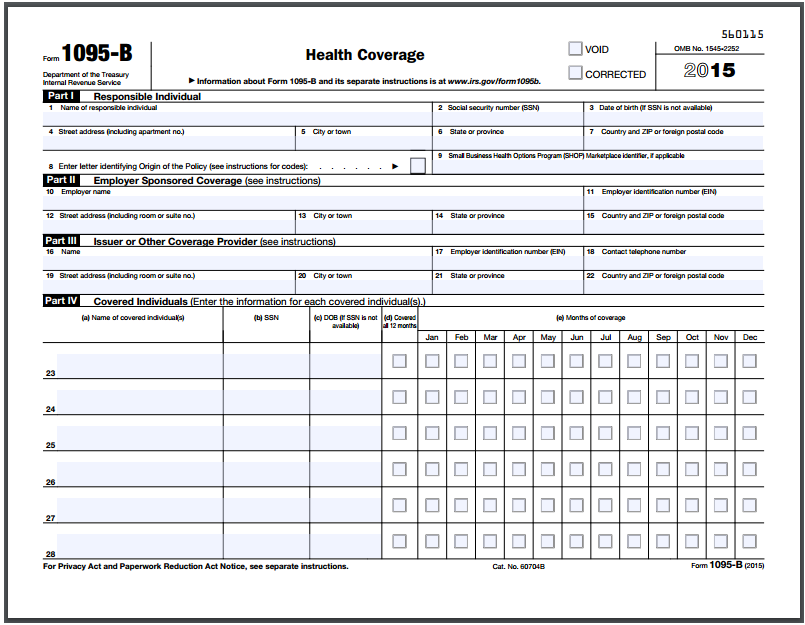

Health Insurance Tax Form Seven Features Of Health Insurance Tax Form That Make Everyone Love It – health insurance tax form

| Pleasant to be able to our website, with this time I’ll teach you concerning keyword. Now, this is the initial photograph:

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)