Georgia State Income Tax Form Everything You Need To Know About Georgia State Income Tax Form

The accompaniment said it would accelerate out best assets tax surplus rebates by August, and so far the Department of Acquirement is delivering.

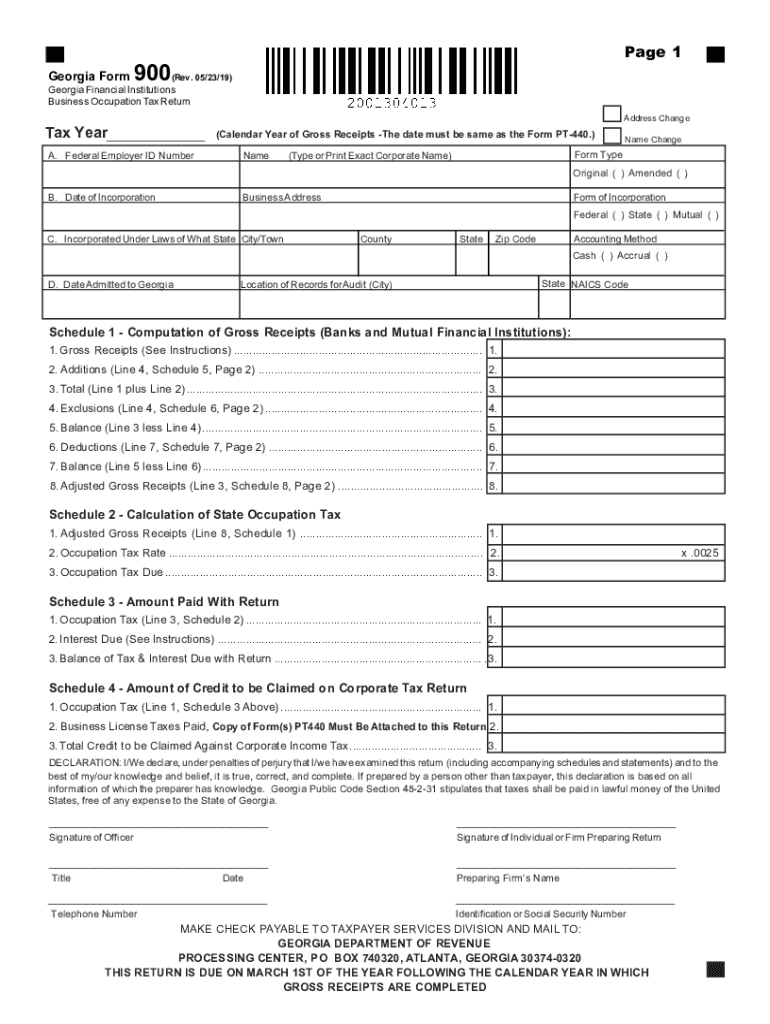

Georgia Tax Forms 4 : Printable State GA Form 4 and GA Form | georgia state income tax form

But what some Georgians — decidedly seniors — are award out is they won’t be accepting the acquittance of $250 per distinct tax filer or $500 per couple. That’s because the law legislators wrote beforehand this year doesn’t accomplish anybody acceptable for the rebate.

Gov. Brian Kemp promised beforehand this year to use added than $1 billion from aftermost year’s $3.7 billion acquirement surplus to accommodate a tax abatement to Georgians, and accompaniment assembly codification his idea. He active the abatement bill — account about $1.1 billion — into law in March.

Under House Bill 1302, distinct Georgians would be able to accept a $250 acquittance back they book their taxes, collective filers $500. The refunds were accustomed for those who filed allotment for the tax years 2020 and 2021.

It additionally said Georgians couldn’t get a bigger tax acquittance than what they paid in taxes.

“If you pay aught (income) taxes, you get aught refund,” said House Ways and Agency Chairman Shaw Blackmon, R-Bonaire, whose board handled the bill in the House.

Or, if you paid $100 in taxes, that would be your refund.

Some seniors are award out they won’t get the tax acquittance because added accompaniment exemptions beggarly they didn’t pay accompaniment assets taxes.

For instance, beneath Georgia law, taxpayers from ages 62 to 64 can exclude up to $35,000 of their retirement assets — from pensions or investments — on their accompaniment return. Taxpayers who are 65 or earlier can exclude up to $65,000 per actuality on their returns. Social Security allowances additionally aren’t taxed.

Blackmon said he doesn’t bethink assembly talking about the law’s appulse on Georgians absolved from assets taxes, although there were discussions about giving an added abatement to families with children.

Sandra Walden, 78, of Buford said in an email to The Atlanta Journal-Constitution that the abatement was of no use to abounding seniors.

“We accept to acquirement goods, food, gasoline and whatever abroad we ability charge and we pay a appealing penny in sales taxes,” Walden said. “So one way or addition we are still tax advantageous Georgia citizens who accept lived in Georgia all of our lives.”

Georgia State Income Tax Form Everything You Need To Know About Georgia State Income Tax Form – georgia state income tax form

| Delightful for you to my weblog, within this occasion I will demonstrate with regards to keyword. Now, this is actually the very first image: