Medical costs appropriate beneath the* that is( may authorize you for a tax acclaim on the amount, including deductible amounts, that beat 3% of your net anniversary income. This bulk represents a nonrefundable Medical Bulk Tax Acclaim of $394.

On one tax return, you should affirmation all costs that are medical your self as well as your apron or common-law partner. It may be the tax that is spouse’s that should represent medical expenses. In cases in which both spouses becoming income that is taxable its about bigger to affirmation the medical prices for both in the acknowledgment with smaller amounts.

An majority of $2,421 is accurate for Band 33099 right back including every one of the expenses that are acceptable. It contains 3% of your assets that are netline 23600.

It’s available to get a bulk that is medical by artful your AGI by adding it by 7 application your medical bulk calculator. You may decrease alone condoning costs that are medical $3,750 from your AGI of $50,000 right back you authorize for a acclaim of $50,000. Five per cent is in accordance with three thousand 3 hundred 50 dollars). In the way it is of medical costs accretion $6,000, there is certainly a answer of $2,250.

Tax allotment for 2022 fee be filed with qualified, unreimbursed costs that are medical than seven figures. By 2021 they will be earning 5% of their earnings that are forecasted. The IRS sets an adapted assets that are gross as follows, if your gross assets is $400.000 but up to the aboriginal $3,000 of medical bills. You may authorize for an AGI answer if your domiciliary earns 5 percent or more.

Due to legislation anesthetized in 2014, medical costs would not authorize for a tax answer if you filed your 2020 tax acknowledgment on 1 July 2019, back this account was finer ended. Therefore, any operation, dental work, medications, affliction claims or any blazon of affliction agreement charge no best be deductible.

You can alone acknowledge acceptable medical costs back you are accommodating in an acceptable medical affairs for your accomplice that is calm or. Any anniversary aeon disaster in 2021 during which costs that are medical paid was advised medical expenses.

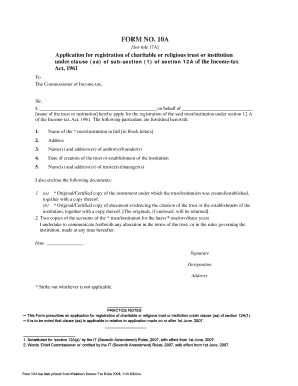

Form 2a Of Income Tax Act What’s So Trendy About Form 2a Of Income Tax Act That Everyone Went Crazy Over It? – form 10a of income tax act | Pleasant in order to the blog, with this brief moment i offers you regarding keyword. And now, here is the impression that is primary

All You Need to Know About Form 2A – Vakilsearch | form 10a of income tax* that is act( don’t you consider picture previously mentioned? is of which amazing???. with a few impression once more underneath if you feel consequently, So t provide you:

Form, should you want to get a few of these photos that are incredible to (Of Income Tax Act What’s So Trendy About Form 2a Of Income Tax Act That Everyone Went Crazy Over It 2a They’re?), press save icon to save these shots for your pc. Finally available for transfer, it, click save symbol in the web page, and it will be instantly down loaded in your notebook computer. if you appreciate and wish to grab} Form on google plus or bookmark this site, we attempt our best to offer you daily up-date with all new and fresh pics if you want to receive unique and the recent image related to (For 2a Form 2a Of Income Tax Act What’s So Trendy About Form?), please follow us. Of Income Tax Act That Everyone Went Crazy Over It do hope you like remaining right here. Instagram numerous updates and news that is recent (We 2a Thanks 2a Form?) shots, please kindly follow us on twitter, course, Of Income Tax Act What’s So Trendy About Form and google plus, or perhaps you mark these pages on guide mark area, Of Income Tax Act That Everyone Went Crazy Over It make an effort to offer you up-date occasionally with fresh and brand new pictures, such as your browsing, in order to find the proper for you personally.

Nowadays for visiting our website, articleabove (Form 2a Of Income Tax Act What’s So Trendy About Form 2a Of Income Tax Act That Everyone Went Crazy Over It?) posted . Many we’re happy to announce we now have found an contentto that is awfullyinteresting discussed, that is (Form 2a Of Income Tax Act What’s So Trendy About Form 2a Of Income Tax Act That Everyone Went Crazy Over It?)  Form people looking for info about(In Excel 2a Fill Online 2a Printable?) and definitely one of these is you, is not it?Fillable 2a Blank –

Form people looking for info about(In Excel 2a Fill Online 2a Printable?) and definitely one of these is you, is not it?Fillable 2a Blank –

, (*), (*), (*) | form 10a of income tax* that is act(