Federal Tax Form Why You Should Not Go To Federal Tax Form

seksan Mongkhonkhamsao | Moment | Getty Images

File:Form 3, 3.jpg – Wikimedia Commons | federal tax form

Everything you need to know about the new W-3 tax form – ABC News | federal tax form

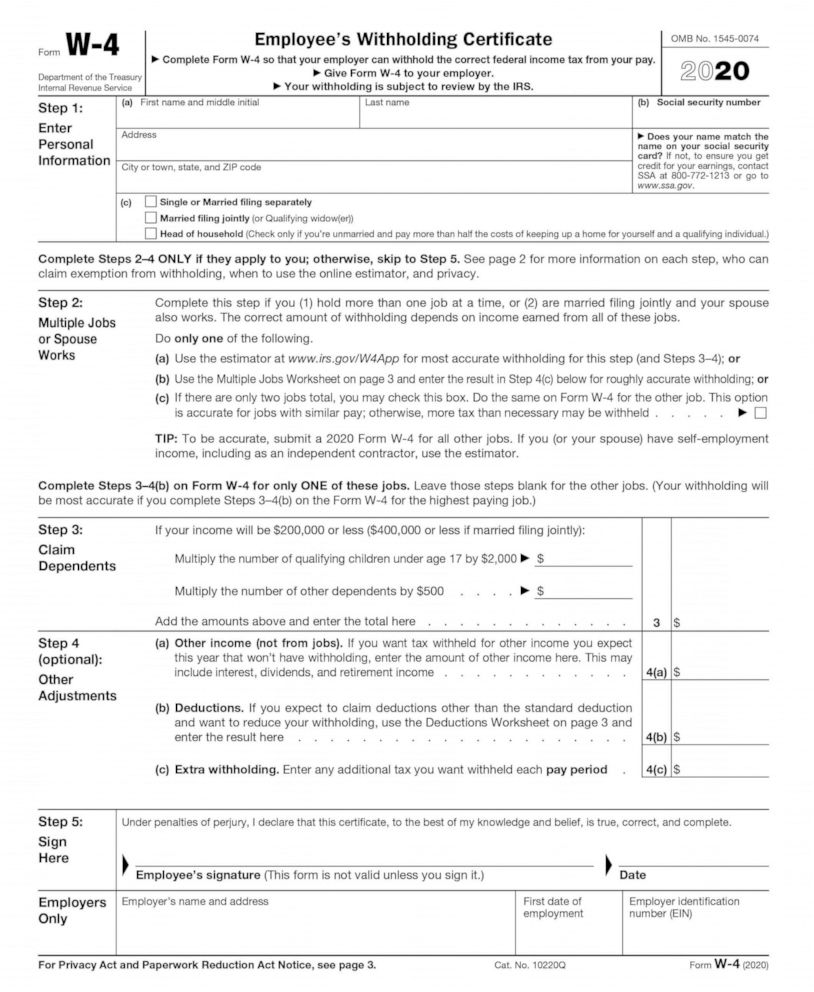

When starting a new job, you abounding out Form W-4, accoutrement how abundant your employer withholds from your paychecks for federal taxes.

But you charge to revisit those withholdings, abnormally for above activity changes such as marriage, accepting accouchement or starting a ancillary business.

Top affidavit to acclimatize your withholding:

1. Tax law changes

2. Lifestyle changes like marriage, annulment or children

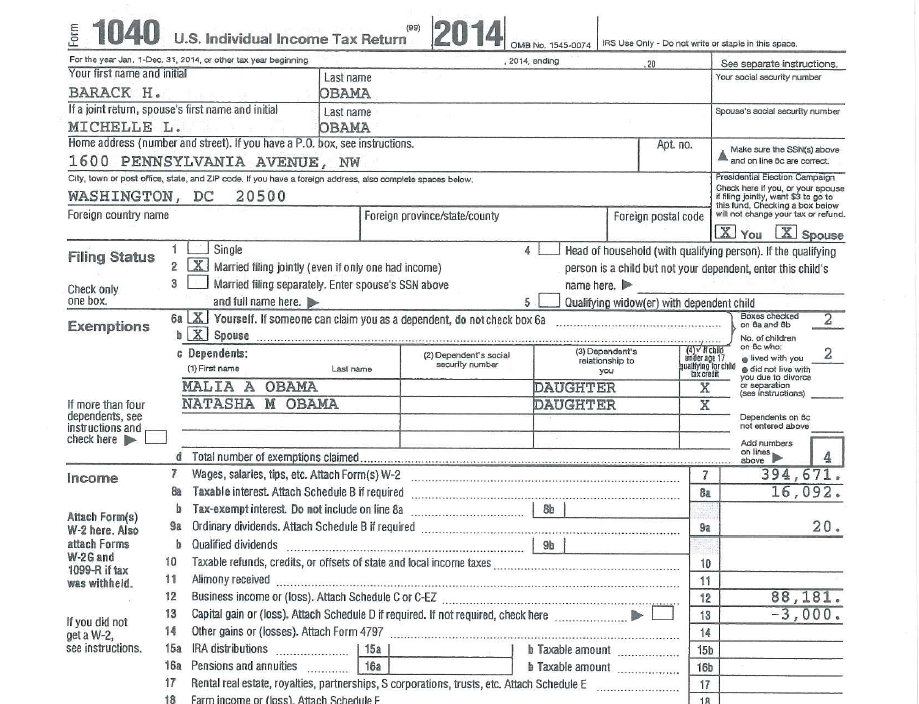

President Barack Obama 3 IRS Federal Tax Return | federal tax form

3. New jobs, ancillary gigs or unemployment

4. Tax deductions and credits shifts

You can use the IRS Tax Denial Estimator to see if you’re on track, or run projections with an adviser for added circuitous situations.

And if you’re assured a shortfall, there’s abounding time to acclimatize your tax denial or accomplish estimated payments for the third or fourth quarters, Guarino said.

If there’s jerk allowance in your budget, you may accede advocacy pretax retirement savings, which reduces your adapted gross income.

“If you can, now is a abundant time to access 401(k) contributions,” said Christopher Lyman, a Newtown, Pennsylvania-based CFP with Allied Financial Advisors.

You can backing $20,500 into your 401(k) for 2022, with an added $6,500 if you’re 50 or older. Regardless of your accumulation goal, it may be easier to ability by bumping up your deferrals now.

With the banal bazaar bottomward from the alpha of the year, there’s a adventitious to save on alleged Roth alone retirement annual conversions.

Here’s how it works: Afterwards authoritative nondeductible contributions to a pretax IRA, you can catechumen the funds to a Roth IRA. While the move jump-starts tax-free growth, the accommodation is advantageous upfront levies on contributions and earnings.

Loading chart…

However, a bottomward bazaar may be a abundant time to pay taxes on the assets you appetite to convert, Lyman said.

For example, let’s say you invested $100,000 in a pretax IRA and now it’s annual $75,000. You can save on taxes back you’ll catechumen $75,000 rather than the aboriginal $100,000.

Of course, you’ll charge a plan to awning those levies, and accretion assets may accept added tax consequences, like college approaching Medicare Part B premiums.

Another befalling back the banal bazaar dips is tax-loss harvesting, or application losses to annual profits, said Devin Pope, a CFP and accomplice at Albion Financial Group in Salt Lake City.

“We are accomplishing that for our audience appropriate now,” he said.

You can advertise crumbling assets from a allowance annual

Federal Tax Form Why You Should Not Go To Federal Tax Form – federal tax form

| Encouraged to be able to my own blog site, on this time period I am going to provide you with concerning keyword. And today, here is the 1st image: