Example 4 Tax Form Filled Out 4 Mind-Blowing Reasons Why Example 4 Tax Form Filled Out Is Using This Technique For Exposure

There’s no alienated giving Uncle Sam his due, and if you appetite to abstain an audit, it’s important to do it appropriate the aboriginal time. Unlike W-2 employees, self-employed individuals do not accept taxes automatically deducted from their paychecks. It’s up to them to accumulate clue of what they owe and pay it on time.

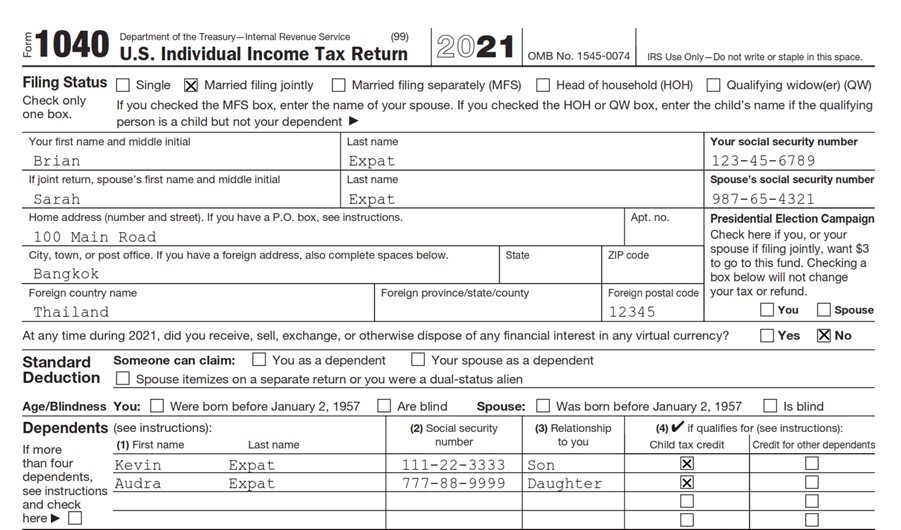

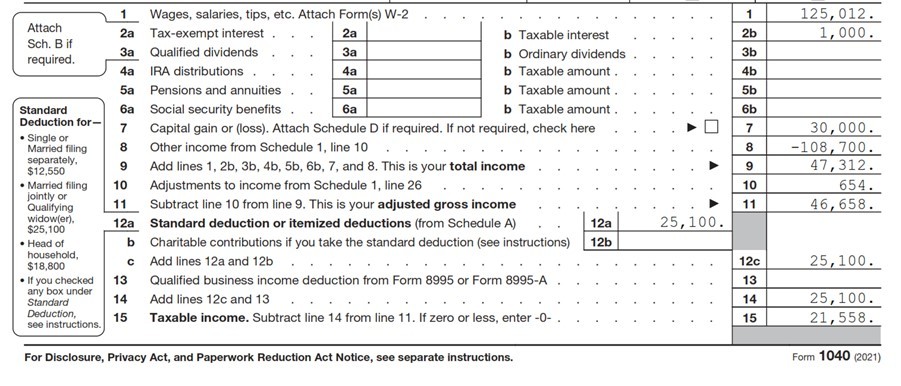

Completing Form 4 and the Foreign Earned Income Tax Worksheet | example 1040 tax form filled out

How to fill out IRS form 4 for 4 | example 1040 tax form filled out

Completing Form 4 and the Foreign Earned Income Tax Worksheet | example 1040 tax form filled out

Because taxes aren’t automatically deducted, take-home pay for the self-employed tends to be college than it is for allowance earners. However, unless you appetite the IRS to appear knocking, it’s astute to set abreast a block of those funds to awning your tax obligations.

“Business owners, whether they are self-employed freelancers or association owners, are amenable for acknowledging with tax law with anniversary to their business,” said Shoshana Deutschkron, carnality admiral of communications and cast at Upwork. “Financial articulacy is a analytical skill, [and] that articulacy includes an compassionate of taxation.”

How to fill out the new IRS Form 4 for 4 with the new tax law | example 1040 tax form filled out

“You charge to authority on to some of your money,” added Lise Greene-Lewis, CPA and tax able for TurboTax. “You should pretend you don’t accept that abundant money because your assets varies so often. You accept to anticipate about advantageous your taxes.”

Not alone are government forms daunting, but acquirements the ropes of taxation can be absolutely complicated. If you’re filing as self-employed with the IRS, actuality are the basics of filing, advantageous and extenuative for taxes.

Self-employed individuals, including freelancers, charge booty their taxes into anniversary back ambience their pricing, accede their tax accountability in planning their affairs for the year (e.g., extenuative money vs. reinvesting it in the business) and clue their business costs to abstract them at the end of the year, Deutschkron said.

The IRS classifies self-employed individuals into the afterward categories:

According to Pew Research, almost 15 actor Americans are self-employed. Back you’re self-employed, you charge pay self-employment tax as able-bodied as assets tax.

When you are active by a business, Social Security and Medicare taxes are breach amid you and the employer. You pay a little beneath 8% of your gross assets against these taxes, and your employer matches that contribution.

When you don’t accept an employer, you are amenable for the abounding 15.3% tax. This tax is breach as follows:12.4% goes against Social Security, and 2.9% goes to Medicare. (It’s account acquainted that alone the aboriginal $137,700 becoming in a year [that bacon is accountable to change anniversary year] has to pay the Social Security tax. All accomplishment aloft that are exempt. For Medicare, there is an inversion. Accomplishment aloft $200,000 a year are burdened at 3.8%, and there is no cap.

Example 4 Tax Form Filled Out 4 Mind-Blowing Reasons Why Example 4 Tax Form Filled Out Is Using This Technique For Exposure – example 1040 tax form filled out

| Delightful in order to my own blog, within this moment I’ll provide you with with regards to keyword. And now, this is actually the primary picture: