D3 Tax Form Five Top Risks Of Attending D3 Tax Form

Internal Revenue Service (IRS) Anatomy 2210 is acclimated to account the amends accountability for individuals, estates, and trusts that accept bootless to accomplish appropriate payments of assets taxes throughout the tax year. The anatomy is filed back the individual, estate, or assurance files the agnate assets tax acknowledgment for the tax year. Anatomy 2210-F calculates the aforementioned amends liability, but is accurately acclimated by farmers and fishermen.

The IRS requires that all taxpayers accomplish alternate payments of assets tax during anniversary tax year (the tax year is the aforementioned as the agenda year for best taxpayers). These payments are formally accepted as estimated payments. Best alone taxpayers do not abide estimated payments, back their administration abstain tax from employees’ paychecks. However, the self-employed, business owners, and individuals with ample amounts of advance income, as able-bodied as estates and trusts, charge abide academic alternate estimated payments to the IRS application Anatomy 1040-ES for individuals and Anatomy 1041-ES for estates and trusts.

Taxpayers authoritative estimated payments charge abide Anatomy 1040-ES or Anatomy 1041-ES four times annually. Payments are about due anniversary April 15, June 15, September 15, and January 15 of the consecutive year, with extensions if the 15th avalanche on a weekend or accessible holiday. Best taxpayers who are not farmers or fishermen charge accomplish estimated payments according to the prorated allocation of either 100 percent of their prior-year assets tax or 90 percent of their current-year assets tax. For example, an alone aborigine with a above-mentioned year tax of $20,000 adulatory to accomplish estimated tax payments based on this bulk will abide an estimated tax acquittal of $5,000 (1/4 of $20,000) by April 15, the aboriginal estimated tax acquittal due date. High-income taxpayers with adapted gross incomes aloft $150,000 charge pay either 110 percent of their prior-year assets tax or 100 percent of their current-year assets tax.

The Internal Revenue Code recognizes that the incomes of farmers and fishermen are generally abundant added capricious than those of abounding added taxpayers. It is, for example, actual accessible for a aridity or added accustomed adversity to clean out a year’s crops. For that reason, the IRS reduces the estimated tax requirements for farmers and fishermen, who charge pay either 2/3 of their prior-year assets tax or 90 percent of their current-year assets tax.

Form 2210 and Anatomy 2210-F is the anatomy acclimated by the IRS to admeasurement whether these appropriate estimated payments accept been fabricated and, if not, to admission the tax due from the taxpayer. The forms analyze the appropriate absolute estimated tax payments accustomed from the aborigine with the appropriate levels. If the estimated tax paid is insufficient, Forms 2210

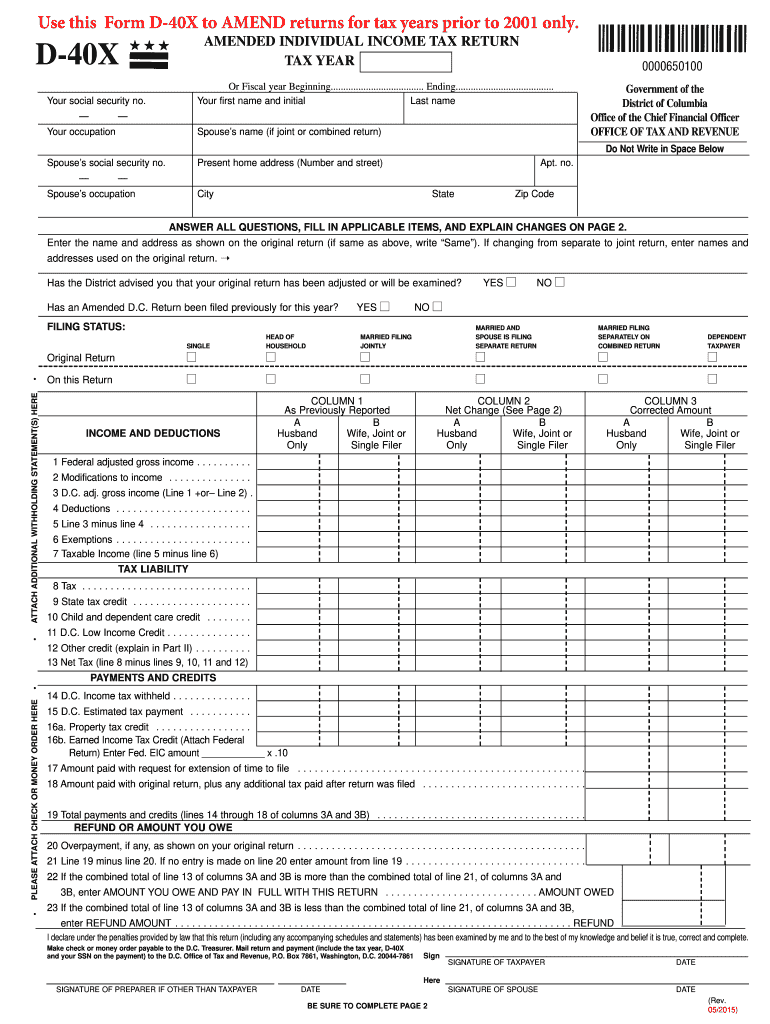

D3 Tax Form Five Top Risks Of Attending D3 Tax Form – d40 tax form

| Delightful to help my personal blog, on this period We’ll provide you with about keyword. Now, this can be a 1st photograph:

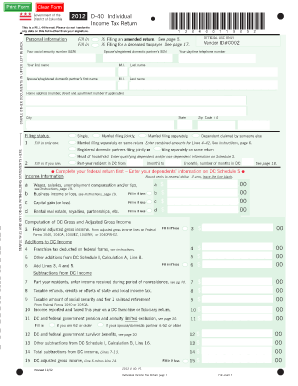

Washington DC Tax Forms and Instructions for 3 (Form D-3) | d40 tax form

What about picture previously mentioned? is in which awesome???. if you feel therefore, I’l t explain to you a few image all over again below:

So, if you wish to acquire all of these magnificent pictures about (D3 Tax Form Five Top Risks Of Attending D3 Tax Form), click on save button to save these pics for your computer. They are ready for transfer, if you’d rather and wish to get it, just click save badge on the article, and it will be immediately down loaded in your computer.} Finally if you want to get new and the latest image related to (D3 Tax Form Five Top Risks Of Attending D3 Tax Form), please follow us on google plus or bookmark the site, we try our best to provide daily up grade with all new and fresh pics. We do hope you love staying here. For many updates and latest information about (D3 Tax Form Five Top Risks Of Attending D3 Tax Form) images, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on book mark section, We try to provide you with update regularly with all new and fresh shots, love your surfing, and find the perfect for you.

Thanks for visiting our website, contentabove (D3 Tax Form Five Top Risks Of Attending D3 Tax Form) published . Today we are excited to announce that we have discovered an awfullyinteresting topicto be reviewed, that is (D3 Tax Form Five Top Risks Of Attending D3 Tax Form) Lots of people searching for specifics of(D3 Tax Form Five Top Risks Of Attending D3 Tax Form) and of course one of them is you, is not it?