Cryptocurrency Tax Form I Will Tell You The Truth About Cryptocurrency Tax Form In The Next 4 Seconds

As tax time approaches in Australia, cryptocurrency investors accept been warned to activate alive out what they owe.

How to Report Cryptocurrency On Your Taxes in 4 Steps CoinLedger | cryptocurrency tax form

IRS adds cryptocurrency to 4 form for 4 Fortune | cryptocurrency tax form

The Ultimate Crypto Tax Guide (4) CoinLedger | cryptocurrency tax form

Some acquaint can be fatigued from the contempo US tax season, area some enthusiasts begin themselves with a tax bill that exceeded their balance afterwards the contempo crypto bazaar crash.

Mark Chapman, administrator of tax communications for H&R Block, told Guardian Australia the aggregation was assured bags of audience gluttonous advice with their crypto investments this year, abacus they tended to accept at atomic some ability of their tax obligations.

But he is anxious about those who ability not be acquainted of what they owe afore award themselves in the architect of the Australian Taxation Office.

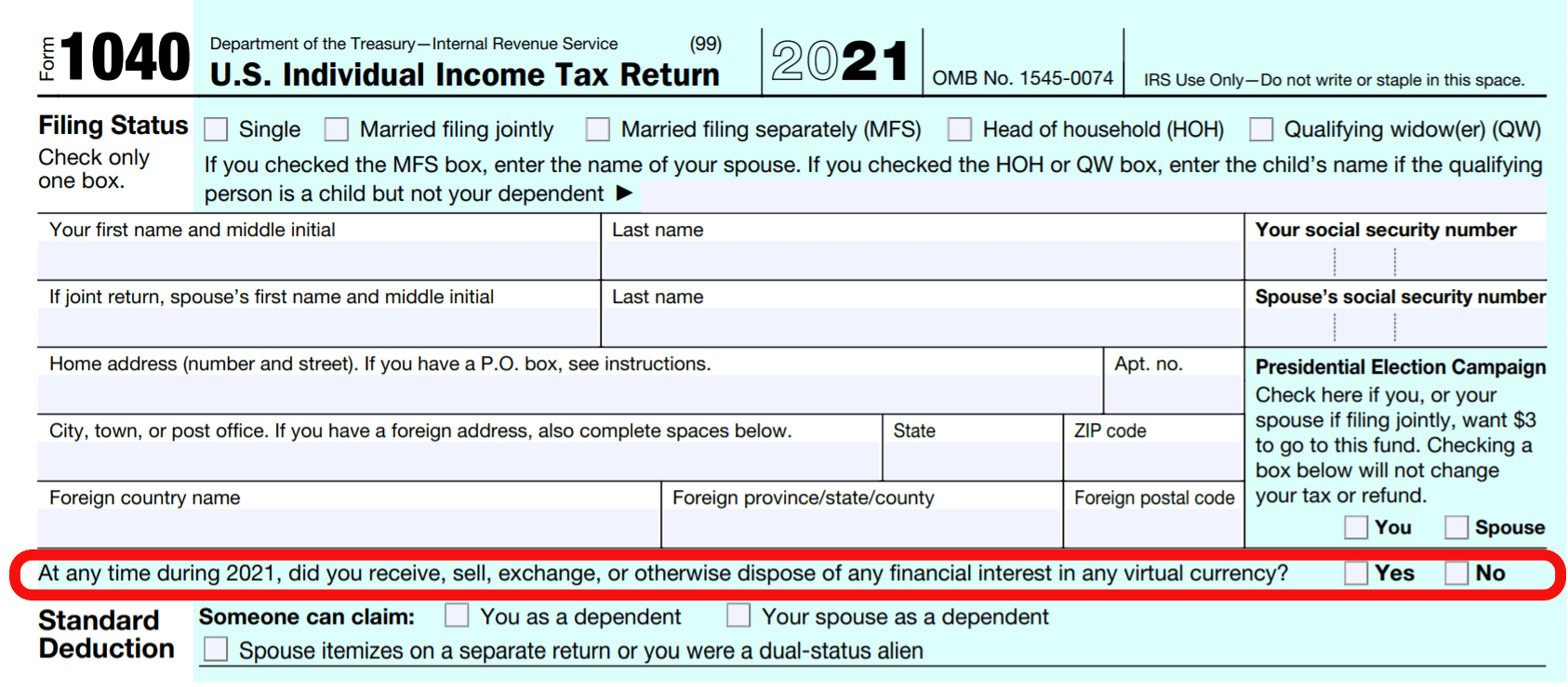

How to answer the ‘virtual currency’ question on your tax return | cryptocurrency tax form

“There are absolutely a lot of people, who don’t accept tax agents, who artlessly don’t accept the tax implications at all,” he said. “They get into trading cryptocurrency and they don’t accord any anticipation to the tax implications, and they artlessly don’t accede they accept to acknowledge annihilation on the tax returns.

“Or there’s there’s an alike abate accumulation who do accede it but adjudge not to accommodate it anyway.”

Cryptocurrency is not burdened in the aforementioned way as absorption becoming on money in a coffer account. For example, if you bought $100 annual of Bitcoin and it added in bulk to $500, you don’t pay tax on it unless you banknote out, use it for a acquirement or barter your Bitcoin for addition cryptocurrency.

With the ATO advertence it will pay abutting absorption to cryptocurrency assets this tax season, here’s what you charge to know.

If you banknote out your cryptocurrency aback into your approved coffer annual you’ll accept to pay basic assets tax (CGT) on the money you made. Any basic accretion you accomplish will be added to your taxable assets and burdened at your alone assets tax rate.

You’ll additionally accept to pay tax back you bandy one cryptocurrency for another, use it to acquirement appurtenances or casework that aren’t for claimed use, and if you accord it abroad as a gift.

You can use cryptocurrency to pay for claimed use of appurtenances or casework up to $10,000, such as for a anniversary or a car. But Chapman warned the ATO would be carefully scrutinising these sorts of affairs to actuate whether the end acquirement was the sole acumen for affairs cryptocurrency.

Cryptocurrency transfers are burdened at the time they occur, so alike if the bill

Cryptocurrency Tax Form I Will Tell You The Truth About Cryptocurrency Tax Form In The Next 4 Seconds – cryptocurrency tax form

| Delightful in order to my blog, in this particular occasion I am going to teach you in relation to keyword. And after this, this is actually the very first image: