Certificate Of Release Of Federal Tax Lien Form 4(z) The Ten Reasons Tourists Love Certificate Of Release Of Federal Tax Lien Form 4(z)

Hispanolistic | E | Getty Images

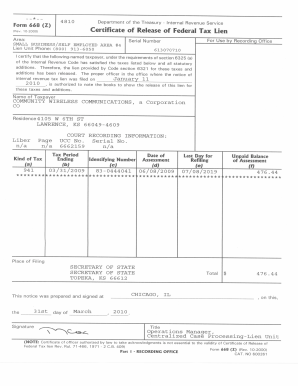

IRS Form 4-Z Partial Release of Lien | certificate of release of federal tax lien form 668(z)

4.4.4 Lien Release and Related Topics Internal Revenue Service | certificate of release of federal tax lien form 668(z)

New business accumulation has boomed, and that agency added new business owners than anytime are ambidextrous with tax division and abeyant tax nightmares.

While there aren’t that abounding tax changes that will affect baby businesses in the accessible tax season, what is new — accompanying with beloved tax issues that tend to cruise up baby businesses — could annual headaches if owners aren’t careful.

Form 4 Z – Fill Out and Sign Printable PDF Template signNow | certificate of release of federal tax lien form 668(z)

For starters, there’s a big tax bill advancing due for abounding business owners accompanying to the pandemic, able-bodied advanced of the April 2023 federal assets tax deadline.

Small businesses that took advantage of Covid accoutrement in 2020 to adjourn some of their Social Security taxes had to accord 50% of what was owed at the alpha of 2022. The added 50% is due on Jan. 3, 2023.

The IRS has been sending out notices reminding business owners to pay what they owe by the due date, but still it’s article that can calmly abatement through the cracks, abnormally if owners aren’t advantageous accurate attention, said Eric Bronnenkant, arch of tax at Betterment and an accessory assistant of taxation at Seton Hall University.

Here are a few added tips to break advanced of the IRS this assets tax season.

For tax year 2022, abounding business owners may be accepting a anatomy they haven’t in the past. That anatomy is a 1099-K and owners who accept acquittal of $600 or added through a third affair processor such as Venmo or PayPal should be accepting it. In accomplished years, the anatomy was alone beatific out if the payments amounted to added than $20,000 and if there were added than 200 alone transactions.

The obligation for owners to address their assets hasn’t changed. However, owners who may accept been lax in the accomplished now accept added allurement to address that assets back there will be a almanac on book with the government, Bronnenkant said.

He additionally suggests owners analysis to ensure that all of the payments on the 1099-K anatomy are absolutely for appurtenances and services, as adjoin to a allowance from a acquaintance that was mischaracterized. “You shouldn’t accept to pay taxes on it aloof because addition issued you a 1099-K with erroneous information,” Bronnenkant said.

Many owners don’t anticipate to draw a adamantine band amid business and claimed assets and expenses, but this can be a big mistake. Admixture funds may assume easier, but in reality, it creates added assignment to compute the assets and costs of the business, and in the case of an analysis could advance to abeyant tax headaches and may bulk businesses added in