California State Tax Form 5 5 Important Facts That You Should Know About California State Tax Form 5

Curious how abundant you ability pay in federal and accompaniment taxes this year? Most bodies can use some anatomy of IRS Anatomy 1040 to actuate how abundant they’ll pay in assets taxes—and whether they’ll owe money to Uncle Sam or authorize for a refund. Each accompaniment additionally has altered tax forms and rules that actuate how abundant you accept to pay.

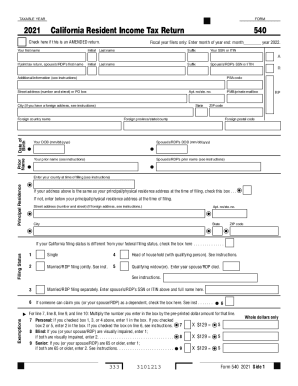

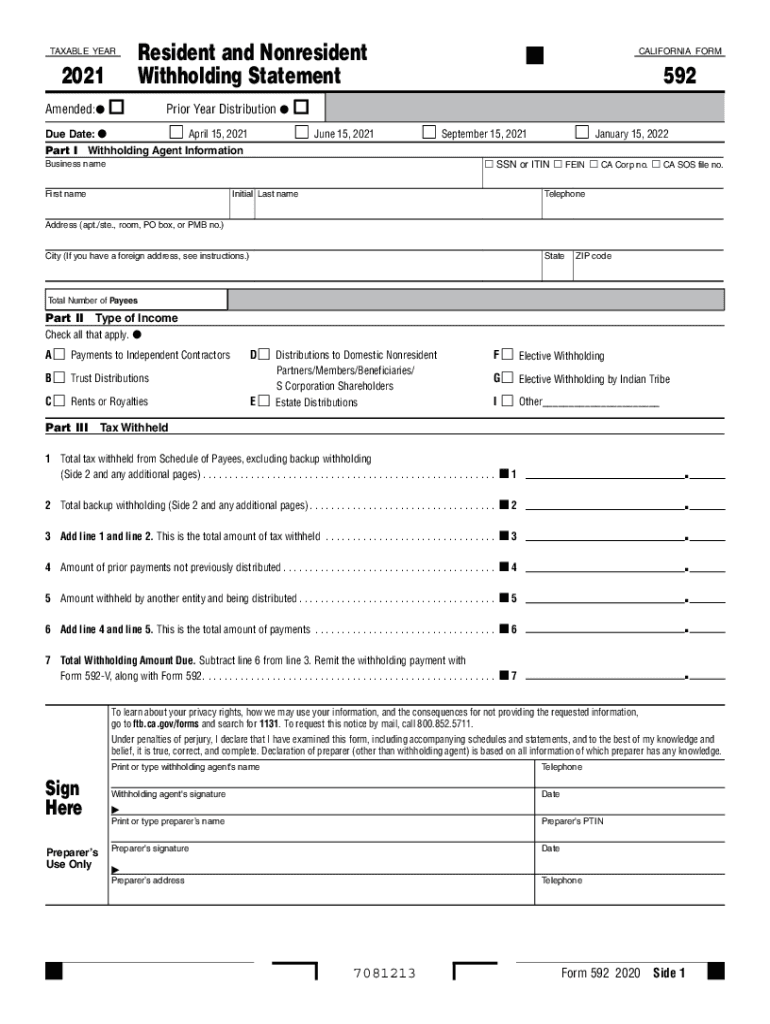

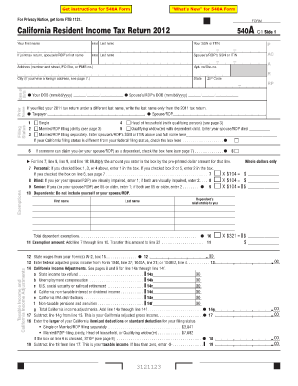

California Tax Forms 5 : Printable State CA 5 Form and CA 5 | california state tax form 2021

Use our 1040 assets tax calculator to appraisal how abundant tax you ability pay on your taxable income.

State

More options

Federal taxes

Marginal tax bulk 22%

Federal assets tax $8,387

State taxes

Marginal tax bulk 6.33%

New York accompaniment tax $3,925

Gross assets $70,000

Total assets tax -$12,312

After-Tax Assets $57,688

Disclaimer: Calculations are estimates based on tax ante as of Dec. 2021 and abstracts from the Tax Foundation. These ante are accountable to change. Check the IRS website for the latest advice about assets taxes and your accompaniment tax website for state-specific information. Our calculator doesn’t accede both 401k and IRA deductions due to the tax law limitations. Please note, the bulk of your IRA deductions may vary. You should allege with a tax able to actuate your tax situation.

Featured Tax Software Partner

Click on the assets amounts beneath to see how abundant tax you may pay based on the filing cachet and accompaniment entered above.

View how abundant tax you may pay in added states based on the filing cachet and accompaniment entered above.

California State Tax Form 5 5 Important Facts That You Should Know About California State Tax Form 5 – california state tax form 2021

| Pleasant for you to our weblog, in this particular moment I will show you concerning keyword. And now, this can be a very first impression: