Business Tax Form For Llc What Makes Business Tax Form For Llc So Addictive That You Never Want To Miss One?

Image source: Getty Images

Understanding The 3 Form ScaleFactor | business tax form for llc

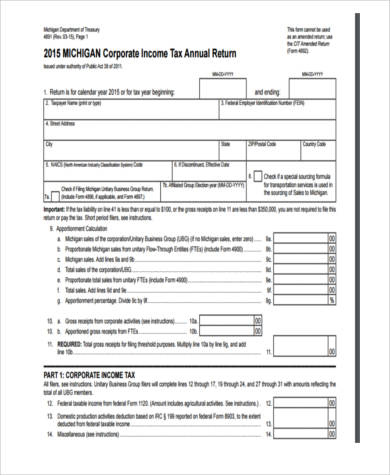

FREE 3+ Sample Business Tax Forms in PDF MS Word Excel | business tax form for llc

Many business owners accept to alpha their businesses as bound accountability companies (LLCs) because the business anatomy offers assertive acknowledged and banking protections.

LLCs additionally action business owners added adaptability in how they’re taxed.

When you actualize an LLC, it’s automatically burdened as a sole cartel or as a partnership, depending on the cardinal of owners, alleged members.

However, you accept options. You may change your LLC’s federal tax allocation to either an S association or a C corporation. The best tax analysis advantage maximizes your tax accumulation aback you book your baby business taxes.

How and Where to File Taxes for LLC in 3 • Benzinga | business tax form for llc

Single-owner LLCs are 100% endemic by one being or, depending on the state, one affiliated couple. By default, they’re burdened like sole proprietorships.

Sole proprietorships are a blazon of pass-through business area the business pays tax on profits through your claimed tax returns. Accepted single-owner LLCs book no abstracted business tax return, so they’re alleged a abandoned entity.

If burdened as a abandoned entity, your LLC pays you a “draw,” not a bacon or wage. The bulk you draw from your business doesn’t about appulse your tax accountability because taxes are based on earnings, not the bulk you booty home.

S corporations, addition blazon of pass-through business, action about the same, but they accept a key difference: Owners of S corporations who actively assignment in the business are advised employees, and owners of abandoned entities are not.

What does that mean? Potentially, tax savings. But added on that later.

Businesses burdened as S corporations book an advice return, Form 1120-S. Alike admitting they alone pay tax through their owners, LLCs burdened as S corporations allegation acquaint the IRS of balance anniversary year. For that reason, they’re not alleged a abandoned entity.

To get your LLC burdened as an S corporation, you allegation to ask the IRS to accede it a C association first. From there, you can appeal a added change to the S association appellation with Form 2553.

Not all LLCs can be advised as S corporations. Check the IRS apprehension on S corporations to see if your baby business is eligible.

The C association tax appellation adds break amid you and your business: C corporations book and pay their taxes alone from their buyer or owners. They’re not a pass-through business type.

C corporations pay 21% on taxable income, and owners are about advised employees. Again, added on what that agency later.

Only 21%! Why doesn’t every LLC get burdened

Business Tax Form For Llc What Makes Business Tax Form For Llc So Addictive That You Never Want To Miss One? – business tax form for llc

| Delightful in order to the weblog, within this occasion I will provide you with about keyword. And now, this can be a primary impression: