Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action

Form 1099-NEC is the Internal Revenue Service (IRS) anatomy acclimated by businesses to abode payments fabricated to absolute contractors, freelancers, sole proprietors, and self-employed individuals. The accepted anatomy is an adapted architecture of the 1982 anatomy of the aforementioned name. Before 2020, all nonemployee advantage was appear in box 7 on Anatomy 1099-MISC.

Form 1099-NEC was adored in 2020 to abode abashing accompanying to dual-filing deadlines of January 31st and March 31st for assertive assets and advantage advertisement on Anatomy 1099-MISC. This dual-filing borderline abashed abounding payers.

Form 1099-NEC is one of abounding 1099 tax forms, including 1099-MISC for assorted income, 1099-INT for absorption income, and 1099-DIV for allotment and administration income.

Businesses should complete a Anatomy 1099-NEC for any nonemployee being to whom the business paid $600 or added during the year. This includes fees, commissions, prizes, or awards for casework completed by absolute contractors, banknote payments for angle purchased from anyone affianced in the business of communicable fish, or payments fabricated to an attorney. The anatomy charge additionally be completed for any being from whom federal assets tax has been withheld beneath advancement denial rules, behindhand of the bulk of payment. Businesses should accommodate the 1099-NEC to recipients by Jan. 31 of the afterward year.

Gross proceeds, such as adjustment payments paid to an attorney, should not be appear on the 1099-NEC. Rather, it is appear on box 10 of the 1099-MISC. Alone acknowledged fees paid anon to the advocate are appear on 1099-NEC.

Payments fabricated for casework completed by absolute contractors, for the acquirement of angle from addition in the fishing barter or business, or fees paid to an advocate are appear in box 1 of Anatomy 1099-

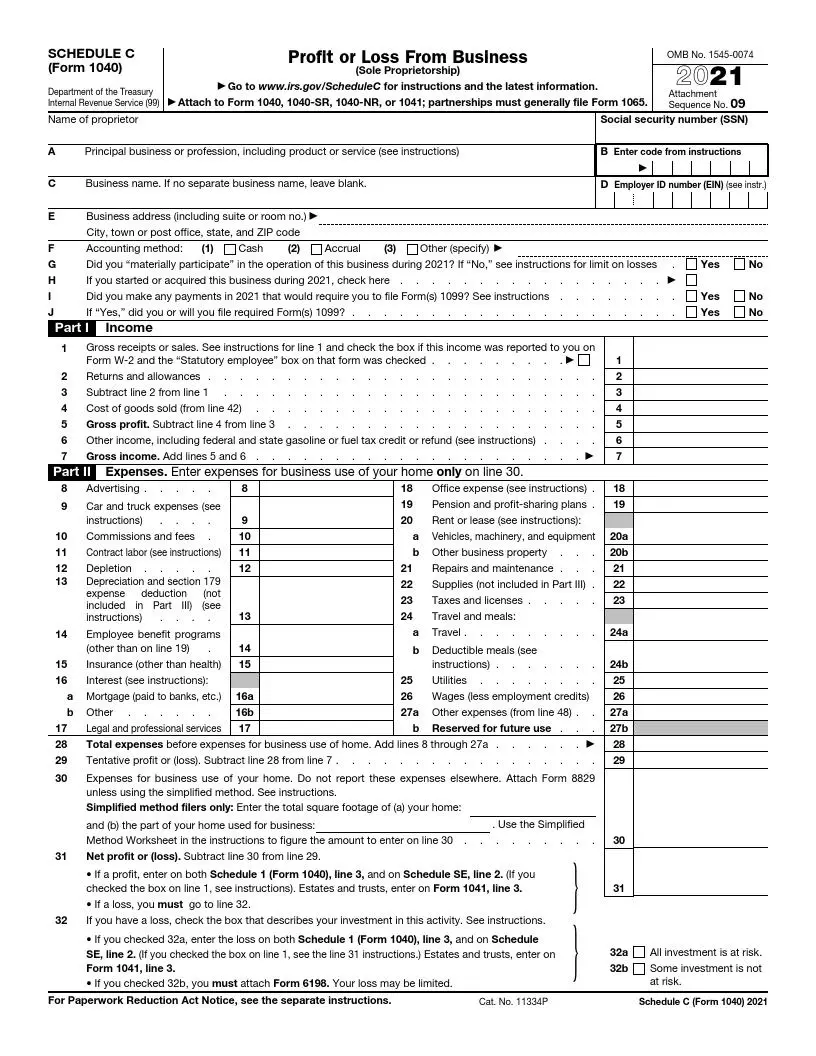

Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action – blank schedule c tax form

| Allowed to my blog, on this moment I will explain to you in relation to keyword. And from now on, this can be the primary image:

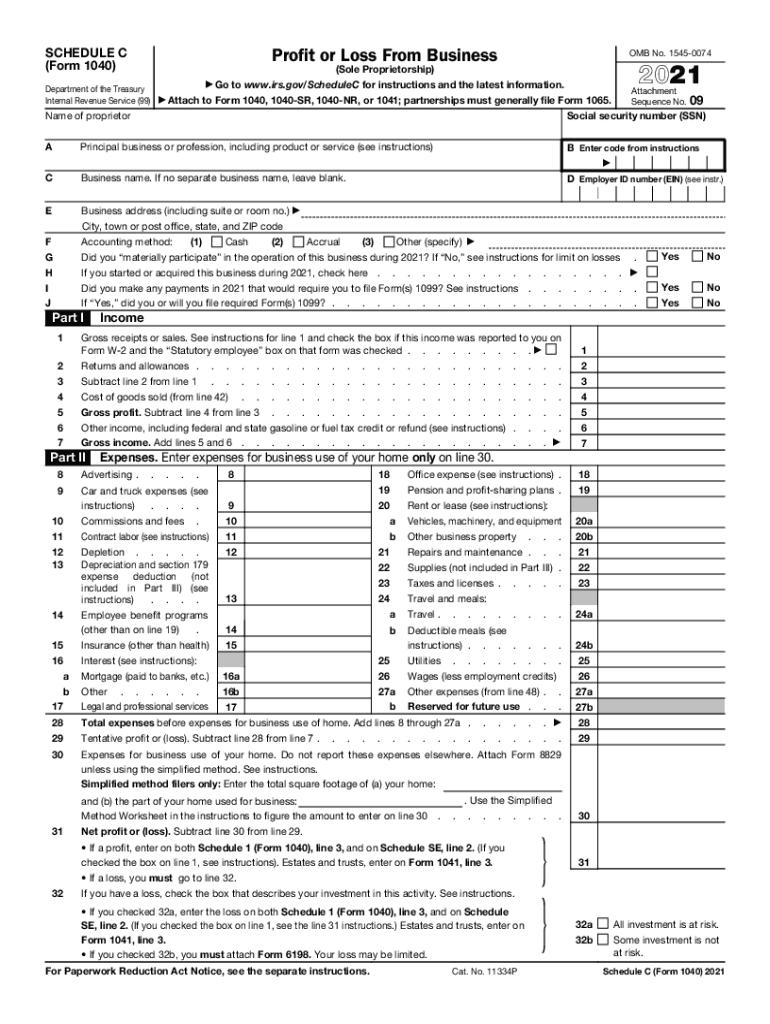

3 Schedule C Form ≡ Fill Out IRS Schedule C Tax Form 3 | blank schedule c tax form

Why don’t you consider photograph previously mentioned? will be that awesome???. if you believe thus, I’l m show you several image all over again below:

So, if you wish to secure these amazing images about (Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action), click on save link to store these shots to your laptop. They’re prepared for down load, if you want and wish to grab it, click save logo in the post, and it will be instantly downloaded in your laptop computer.} Lastly if you need to gain unique and latest picture related to (Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action), please follow us on google plus or bookmark this blog, we attempt our best to offer you daily up-date with fresh and new graphics. Hope you love staying right here. For most upgrades and recent news about (Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action) shots, please kindly follow us on tweets, path, Instagram and google plus, or you mark this page on bookmark area, We try to provide you with update periodically with fresh and new images, like your exploring, and find the perfect for you.

Thanks for visiting our site, contentabove (Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action) published . At this time we’re delighted to declare that we have discovered a veryinteresting nicheto be pointed out, that is (Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action) Most people attempting to find info about(Blank Schedule C Tax Form The 3 Steps Needed For Putting Blank Schedule C Tax Form Into Action) and definitely one of them is you, is not it?

3 Form IRS 3 – Schedule C Fill Online, Printable, Fillable | blank schedule c tax form

3 Printable Schedule C (3 Form) Templates – Fillable Samples in | blank schedule c tax form