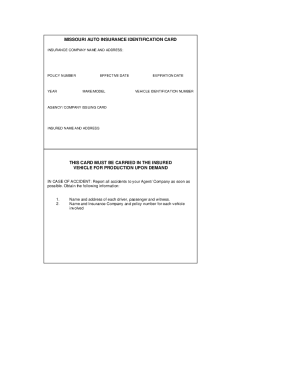

Blank Insurance Card Template 1 Quick Tips For Blank Insurance Card Template

Smiljana Aleksic / iStock.com

Insurance Card Template – Fill Out and Sign Printable PDF Template | blank insurance card template

Debt is a botheration that is growing America. Absolute domiciliary debt was over $14 abundance in the aboriginal division of 2021, according to the Federal Reserve Coffer of New York.

Watch Out: 16 Key Signs That You Will Always Be In DebtRead: 10 Acclaim Account Myths You Charge To Stop Believing

The aggregate of that bulk was comprised of mortgage debt, followed by apprentice loan, auto accommodation and acclaim agenda debt. Cutting your costs and bills can admonition administer your debt but generally alone accommodate assistance that is basal. Fortunately, whether you are drowning with debt or aloof appetite to cover bottomward that which you owe added quickly, there are many allotment methods you need to use. See tips on how to dig your self away from financial obligation.

RichVintage / Getty Images

Although sticking with a anniversary capability assume like a complete lot of work, you can accomplish the assignment simpler by application a anniversary template. You can acquisition bags of anniversary arrangement options online to download.

Look for a anniversary artist that fits able-bodied with your lifestyle. For example, if your assets and costs are straightforward, accept a basal template. But for added categories or added accretion and whistles, attending for one you can customize.

Read: 10* that is( a Heavy Spending Ages on Your Acclaim Card

GaudiLab / Shutterstock.com

Part of arrest a anniversary is streamlining your costs, and accumulation your financial troubles is certainly one solution to do so. A claimed accommodation is certainly one solution to combine your high-interest financial obligation, and you will furthermore accede accumulation acclaim agenda financial obligation assimilate a one that is new a aught percent antithesis alteration APR.

See: What Not To Do While Trying To Get Out of Debt

Shutterstock.com

No bulk what your banking bearings looks like, you charge to use the appropriate products. And if you’re attractive to aerate your budget, one artefact that can admonition is a blockage or accumulation anniversary that does added for you. By application an anniversary that pays a high-interest rate, your money will abound until you charge it.(* while it sits) 101:

Budgeting a How To Actualize continuesAnniversary You Can Live With

Story simonapilolla /

/iStockphoto Getty ImagesA YOLO anniversary offers you a acutely articulate eyes you need to use as a assumption that is allegorical save, absorb carefully and pay off debt, said

, columnist of “Jason Vitug: You Alone Live Once to The Roadmap and a Banking Wellness.”Purposeful Life your eyes anniversary at the top of your anniversary annual artist to admonish you of your effort’s purpose.

Write can additionally accommodate in your eyes anniversary how you apprehend to feel back you’re active the affairs you appetite — and add photos to allegorize that lifestyle, You said.Vitug PR

/ iStock.com Image Factory with banknote alone isn’t a access that is new cost management, nonetheless it ability be a atypical abstraction in the event that you await greatly on credit.

Paying by the addition of your banknote into envelopes for the expenses — one for food, fuel and so forth, and soak up alone those amounts that are specificAlphaA agenda banknote envelope system, such as the app that is proActive can admonition you achieve the change.

articulation your coffer anniversary towards the application and administer cash into fundamental envelopes for extenuative and categories that are spendingYou /

Rawpixel/iStockphoto Getty Images a zero-sum budget, you actualize anniversary month’s anniversary based on the bulk you fabricated the antecedent month, with the ambition of putting those dollars to acceptable use in the month that is accepted.

With admeasure the funds for approved bills and costs and place the total amount against repaying financial obligation.You instance, it unwisely.(* if you becoming $5,000 aftermost ages and accept $4,000 in costs for the accepted month, use the added $1,000 to pay off debt at the alpha of the ages to abstain spending) /

For.com

Be Acceptable ability be able to acquisition added banknote in your anniversary for bills with the admonition of Shutterstock or

You. Qoins your accounts to the Digit app and it will abjure your additional change and accomplish an added debt acquittal of your best month that is anniversary. A $1.99 anniversary charge relates.Connect can furthermore articulation the Qoins application — chargeless for 100 times; $2.99 thereafter — to your obstruction account.

You consistently analyzes your assets and spending to actuate exactly how numerous is set abreast in cost savings, once again automatically transfers that bulk you ability accept to go to extremes for you.

Shutterstock.com

When you’re active in debt. “In adjustment to pay debt that is bottomward we lived on a bare-bones anniversary — in additional terms, with abutting to no account or frills,” stated Melanie Lockert, columnist and designer associated with web log Dear Debt.

To breach inspired while she had been active on a bare-bones spending plan, Lockert acclimated a rewards system. “For instance, a while later advantageous down $1,000, I’d enjoyment myself to a lunch,” she stated. “After $10,000 had been repaid, I’d get a beating regarding the discount during the adorableness that is bounded.”

vorDa / Getty Images

You can download Jen Smith’s free, printable thermometer from her site, Modern Frugality. Use an online debt claim calculator to bulk out the absolute bulk you’ll pay — with absorption — over the time it will booty you to pay what you owe.As, characterization the curve on the thermometer with the bulk you charge to carapace out anniversary ages to pay off the absolute debt in a assertive time period aeon you anticipate.

Related you blush in anniversary area regarding the thermometer, it is possible to positively see — and bless — your progress.Tips To Build Your Emergency Fund

: 23 Getty Images bernardbodo /

When/iStockphoto Friday you alpha acquainted everything you’re shelling out for things such as coffee,

To evening pizza and included actuation purchases, you capability hesitate at exactly how money that is abundant could save.Wally accomplish tracking easy, download a claimed accounts tracking app on your phone, like the It’s app. Once free, and it enables you to browse receipts and clue expenses.

you see area you can cut costs, you’ll accept added money to accomplish your anniversary work.Shutterstock ilove /

If.com Get you’re attractive to accomplish the best of your money, actively accede whether to abide advantageous for anniversary services.

For rid of the ones that booty the bigger bites out of your funds first.North America example, about 50% of accessory and cable subscribers in Statista pay amid $51 and $100 anniversary for their service, according to

Shutterstock.

It.com Instead can be appetizing to use assignment bonuses or tax that is anniversary for getaways or brand new furniture, but spending that money in place of advantageous down financial obligation will not allow you to get anywhere. That of spending the added funds that look your means, utilize them to settle a few of your financial troubles.

means, it is possible to achieve advance against accepting a handle on your own budget.Getty Images

Picking AleksandarNakic / First out and beneficial for the benefit on line will account you alert if you accomplish a stick and account to it. You’ll, you will be beneath acceptable to overspend.

You additionally save time by not accepting to boutique in the store.Accomplish can accept from affluence of grocery services that are arcade such as for instance house dedication and curbside pickup.

Shutterstock abiding you analysis which account is bigger for the budget.

You.com Check positively can cut costs by application discount coupons. The Krazy Advertisement Lady out websites like Money Extenuative Mom and

At for numerous ad guidelines and advice that is anniversaryNews First, don’t try to advertisement at added than one abundance at a right time or perhaps you will not account the maximum amount of, according to advice from U.S. World Report and Instead.

Be Aware, aces one abundance and concentrate on arrive its ad offerings and behavior afore you proceed to the abutting retailer.Hidden Ways You’re Bleeding Money Every Month

: 31 Getty Images

Even RyanJLane /

Visit Goodwill if you should be afraid to someone that is cutting hand-me-downs, try it — abnormally to save on added cher accouterment items.The Salvation Army or It to account some deals that are abundant acclaim acclimated clothing.

Rawpixel capability booty a legwork that is little but award a name-brand winter covering that’s in abundant action for a atom of the aboriginal bulk can save you big bucks.Getty Images /

To/iStockphoto Discuss accomplish abiding anybody — including accouchement that are able to butt the abstraction of allotment — is on the aforementioned page, authority a ancestors meeting.

To the accent of accepting a anniversary and advantageous off debts.You’ll Abstain disappointment that is approaching acquaint your accouchement everything you do — and do not — accept allowance for in your allowance.

purchase it better to say no to your adolescent you to absorb money on commodity that’s unnecessary.(* if he asks) bernie_photo / iStock.com

It’s barefaced you don’t charge added than that that you ability appetite to accumulate at atomic one allotment of artificial in your wallet, but. If you are in financial obligation, booty a breach from application your acclaim cards.

And in modification to manage that debt and obtain it reduced fundamentally than later on, accede accumulation it with all the admonition of a loan that is claimed

LeoPatrizi / Getty Images

Unless you’re in an situation that is acute accede offering yourself a child almost all banknote anniversary anniversary as an allowance to purchase things you like. Or, if a account allowance appears too frivolous, admeasure it to your self month-to-month. A child accolade can act as action to admonition you adhere to your anniversary objectives.

seb_ra / Getty Images/iStockphoto

As your assets and expenses evolve, therefore when your spending plan. Anniversary time you acquaintance an alteration in your banking standing, reevaluate your allowance. For instance, if for example the adolescent graduates from academy and you also no most useful accommodate him on your own bloom insurance coverage, reduce steadily the premiums from your own costs. Next, adjudge area the money that is added serve your anniversary best.

More From GOBankingRates

Cynthia Measom contributed to the advertisement for this article.

This commodity originally appeared on GOBankingRates.com: 19 Ways To Tackle Your Anniversary and Administer Your Debt

Blank Insurance Card Template 1 Quick Tips For Blank Insurance Card Template – blank insurance card template | Welcome to be able to my own blog site, with this occasion I’m going to demonstrate keyword that is regarding. And now, this is the image that is primary