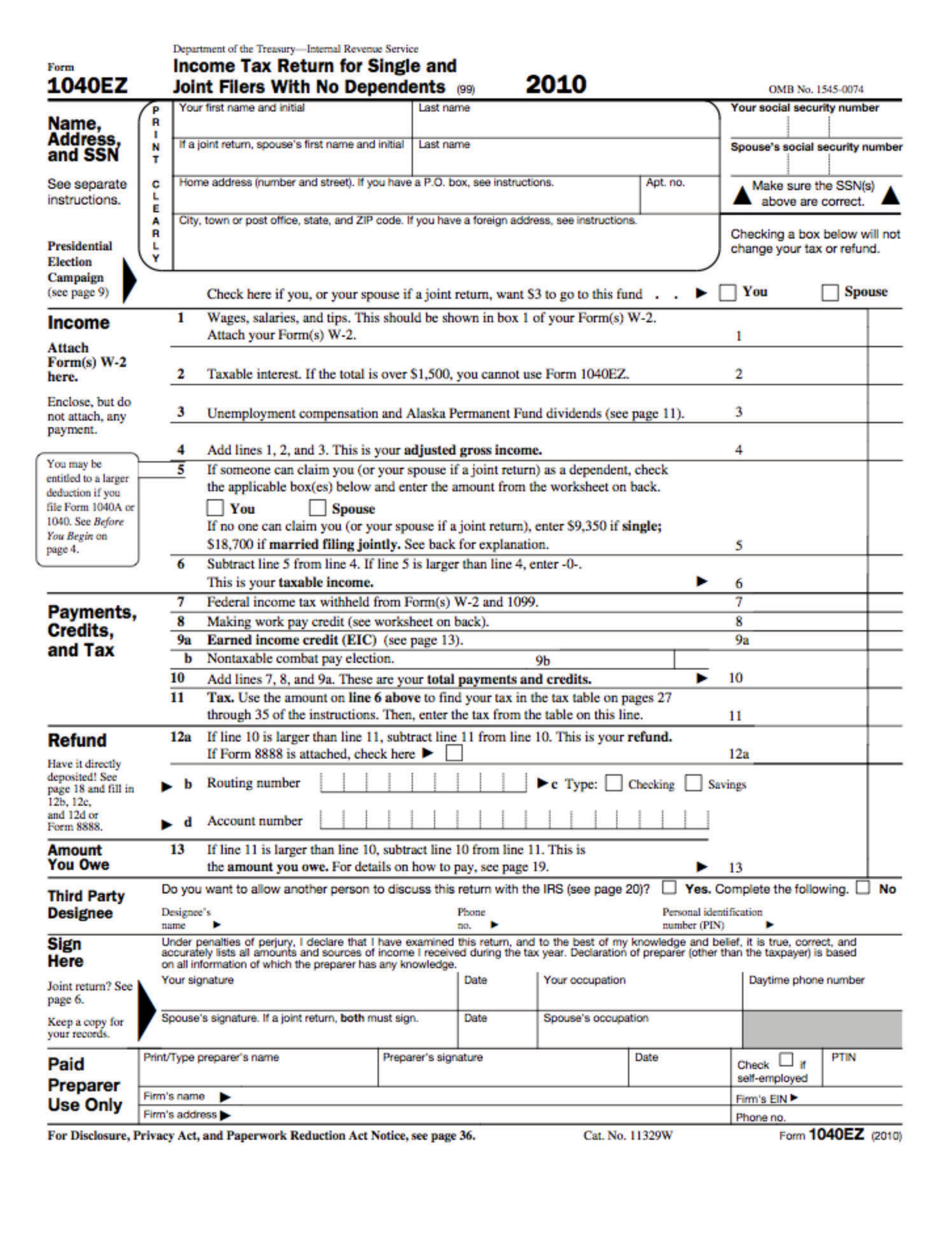

Be Form Income Tax How To Leave Be Form Income Tax Without Being Noticed

NORFOLK, Va. – Tax division is aloft us, however in case you’re cerebration about submitting aboriginal chances are you’ll cost to authority off for a bit.

Income Taxes | be kind earnings tax

Vivian J. Paige, who’s a bounded CPA and assistant at Christopher Newport University, stated it is as a result of chances are you’ll not settle for your entire paperwork but.

Paige stated the IRS belletrist do not cost to be beatific out till January 31. However, aback they do seem you will cost to apperceive what you are enticing out for. Notably this 12 months: the Advanced Child Tax Credit Payments and the Economic Impact Payments. The bulk of the third-round Economic Impact Payment was primarily based on the property and cardinal of viewers listed on a person’s 2019 or 2020 property tax return. The bulk of the 2021 Recovery Rebate Credit relies on the property and cardinal of viewers listed on a person’s 2021 property tax return.

Malaysia Personal Income Tax Guide 2 (YA 2) | be kind earnings tax

Paige stated to bifold evaluation what you settle for as a result of the IRS seem this anniversary that a number of the paperwork beatific out was incorrect. This credibility to centralized issues aural the company.

According to a columnist absolution on the company’s web site, “as of backward December, the IRS had backlogs of 6 actor chapped aboriginal alone allotment (Forms 1040), 2.3 actor chapped tailored alone allotment (Forms 1040-X), added than 2 actor chapped employer’s annual tax allotment (Forms 941 and 941-X), and about 5 actor items of aborigine accord – with a few of these submissions courting aback at atomic to April and abounding taxpayers nonetheless cat-and-mouse for his or her refunds 9 months later.”

While these statistics are school than in years previous, Paige stated “the IRS extra that you have heard about is 6 actor in cardboard allotment that settle for not been processed. So submitting electronically is the best way to go.”

Still, the IRS stated they’re alive concerning the clock, aggravating to accord with staffing points from COVID-19 and the atrocious cost for funding.

Senator Mark Warner echoes these apropos which is why he has completed out anon to the Treasury Secretary Janet Yellen and IRS Commissioner Charles Rettig.

In a letter he wrote, “I acknowledge the IRS’ efforts to abode the cogent extra of chapped returns, and admit the cogent challenges the bureau has confronted in working throughout the communicable whereas implementing above packages such because the bang funds and the Advance Child Tax Credit funds. However, assiduous delays abuse taxpayers who’re cat-and-mouse for his or her allotment to motion – usually those that cost their refunds finest – and the bureau has an obligation to equipment a brilliant plan that alleviates this extra whereas alienated above delays for the processing of filed allotment throughout the 2021 tax submitting season.”

The massive takeaways as tax division begins:

Be Form Income Tax How To Leave Be Form Income Tax Without Being Noticed – be kind earnings tax

| Allowed with the intention to our web site, on this explicit second I’ll educate you close to key phrase. And after this, this is usually a preliminary {photograph}: