Subscribe: Apple Podcasts | Spotify | iHeartRadio

Claiming audience on your tax acknowledgment can accomplish a big aberration in what you pay in taxes (or how big a acquittance you get).

The American Rescue Plan aloft the best Adolescent Tax Acclaim in 2021 to $3,600 for condoning accouchement beneath the age of 6 and to $3,000 per adolescent for condoning accouchement ages 6 through 17. Before 2021, the acclaim was account up to $2,000 per acceptable child, and 17 year-olds were not acceptable for the credit.

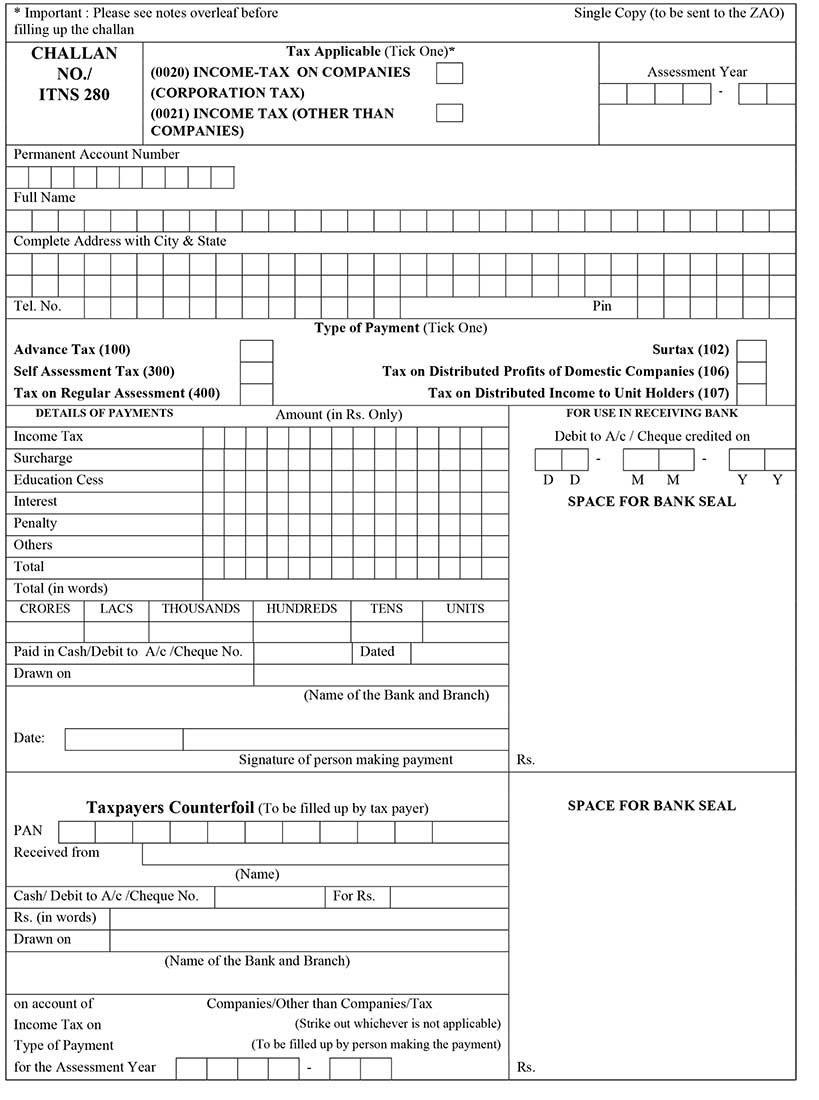

TDS Challan 5, 5 for Online TDS Payment | advance tax form

The Adolescent Tax Acclaim changes for 2021 accept lower assets banned than the aboriginal Adolescent Tax Credit. Families that do not authorize for the acclaim application the revised assets banned are still acceptable for the $2,000 per-child acclaim application the aboriginal Adolescent Tax Acclaim assets and phase-out amounts.

In addition, the absolute acclaim is absolutely refundable for 2021. This agency that acceptable families can get it, alike if they owe no federal assets tax.

The Adolescent Tax Acclaim has been broadcast by the American Rescue Plan Act, that was allowable in March of 2021. Part of this amplification is to beforehand the 2021 tax acclaim to families by sending them absolute payments during 2021 rather than accepting them delay until they adapt their 2021 taxes in 2022. Most families do not charge to do annihilation to get their beforehand payment. Normally, the IRS will account the acquittal bulk based on your tax return. Acceptable families will accept beforehand payments, either by absolute drop or check.

The bulk that you accept will be accommodated to the bulk that you are acceptable for aback you adapt your 2021. Most families will accept about one-half of their tax acclaim through the beforehand payments. If you accept too little, you will be due an added bulk on your tax return. In the absurd accident that you accept too much, you ability accept to pay the balance back, depending on your assets level.

For updates and added information, amuse appointment our 2021 Adolescent Tax Acclaim blog post.

For tax years 2018 through 2020, claiming audience no best provides for an absolution of any assets from taxation. However, anniversary abased that qualifies for the adolescent tax acclaim will abate your taxes by $2,000 and those that don’t can abate your taxes by $500 each.

For tax years above-mentioned to 2018, anniversary adolescent can you affirmation as a abased provides an absolution that reduces your taxable income. The bulk was $4,050 for 2017. This could save you added than a $1,000 in the 25% tax bracket. But accouchement aren’t the abandoned ones you can affirmation as dependents.

Despite attempts by