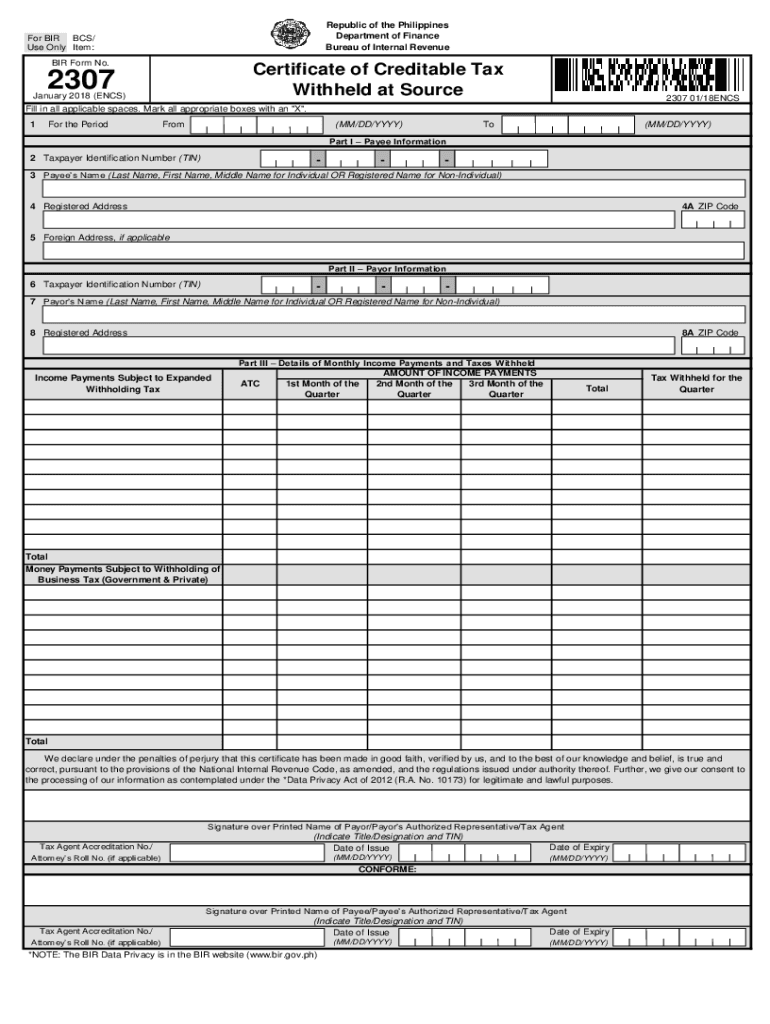

Bir Withholding Tax Form 5 Advantages Of Bir Withholding Tax Form And How You Can Make Full Use Of It

Published May 6, 2022 5:58pm

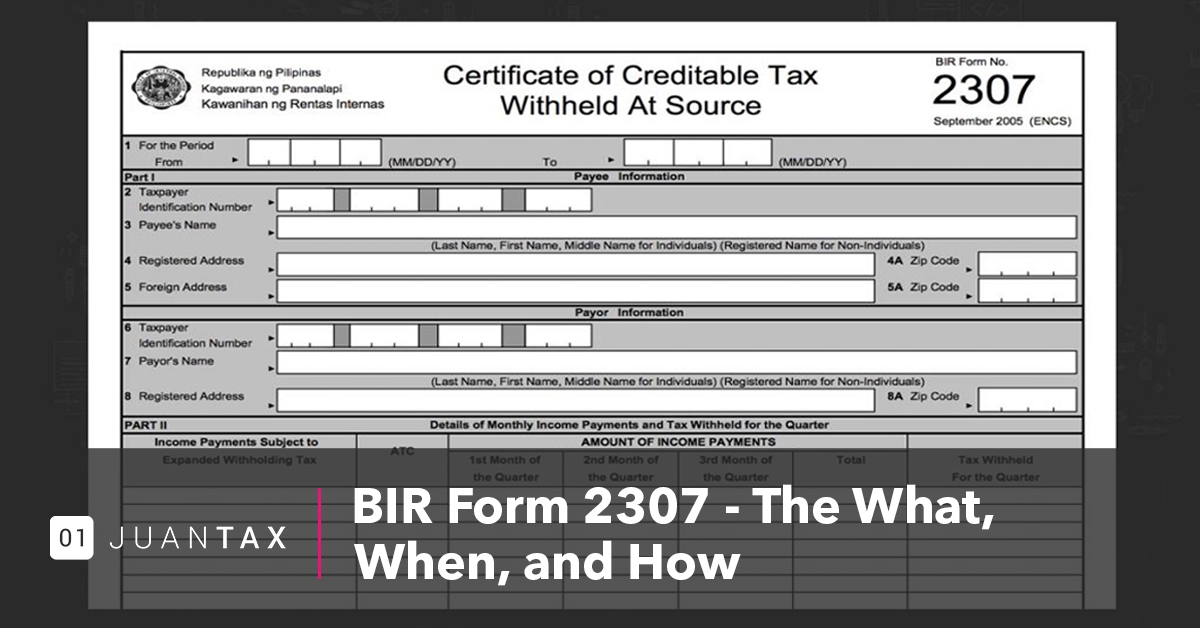

BIR Form 5 – The What, When, and How | bir withholding tax form

The Agency of Internal Revenue (BIR) on Friday reminded candidates and those accommodating in the civic and bounded elections of their tax obligations as voters arch to the acclamation on May 9.

In a statement, the BIR said that aural 30 canicule afterwards the elections, “every applicant and broker of the political parties/party account groups, whether acceptable or losing, shall abide the Account of Contributions and Expenditures (SOCE) to the Comelec and Revenue District Appointment (RDO) area the candidates/political parties/party account groups are registered.”

The taxman’s post-election tax acquiescence reminders are independent in its Revenue Memorandum Circular (RMC) No. 22-2022, issued on February 21, 2022.

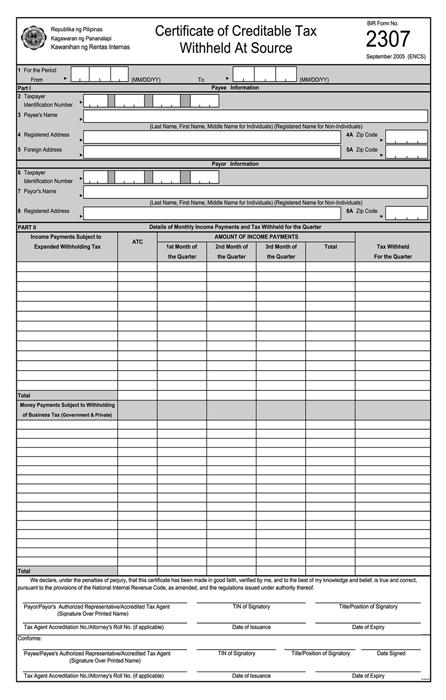

Form 5 | bir withholding tax form

“All candidates, political parties and affair account groups who bootless to annals and accede with the requirements of the BIR will be subjected to penalties beneath the Revised Consolidated Schedule of Compromise Penalties for Violations of the Civic Internal Revenue Code of 1997, as amended,” it said.

The BIR additionally antiseptic the affair of the taxability of attack contributions.

The agency said that “[a]s a accepted rule, attack contributions are not included in the taxable assets of the applicant to whom they were given, the acumen actuality that such contributions were accustomed not for the claimed expenditure/enrichment of the anxious candidate, but for the purpose of utilizing such contributions for his/her campaign.”

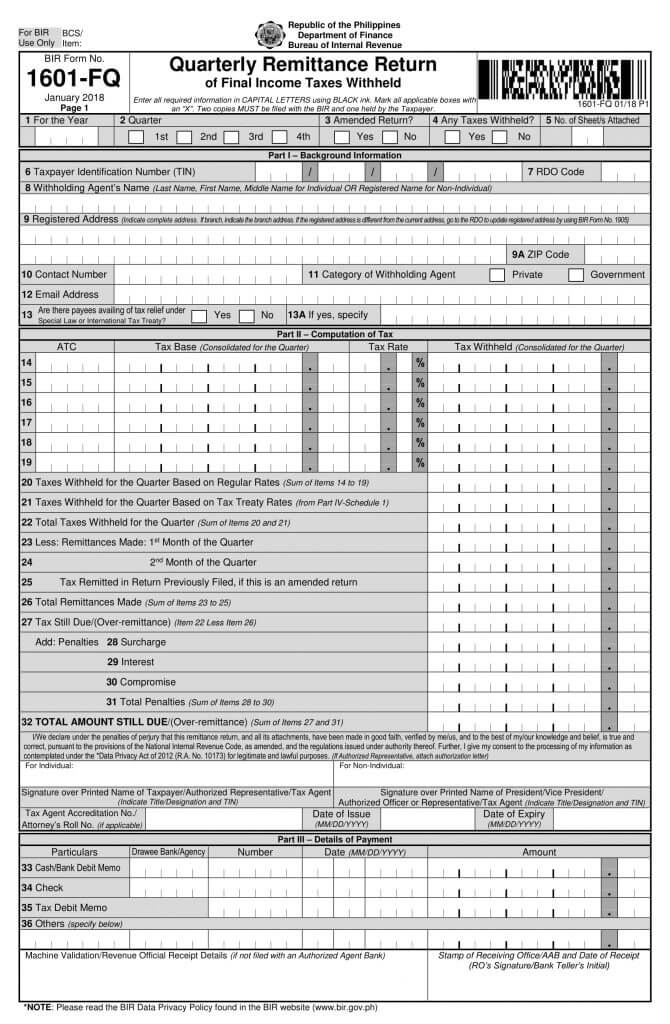

Form 5-FQ | bir withholding tax form

“Thus, to be advised as absolved from the Assets Tax, these attack contributions allegation accept been activated to awning a candidate’s expenditures for his/her balloter attack during the attack period,” it said.

However, unutilized or balance attack funds, as able-bodied as donations activated afore the attack period, net of the candidate’s or political party’s or affair list’s attack expenditures, “shall be advised as accountable to Assets Tax and, as such, allegation be included in their/his taxable assets as declared in their/his Assets Tax Return (ITR) pursuant to RR No. 7-2011,” the BIR said.

Donor’s tax is not imposed on banknote or in-kind contributions fabricated to any candidate, political party, or affair account accumulation that are appropriately appear to the Commission on Elections.

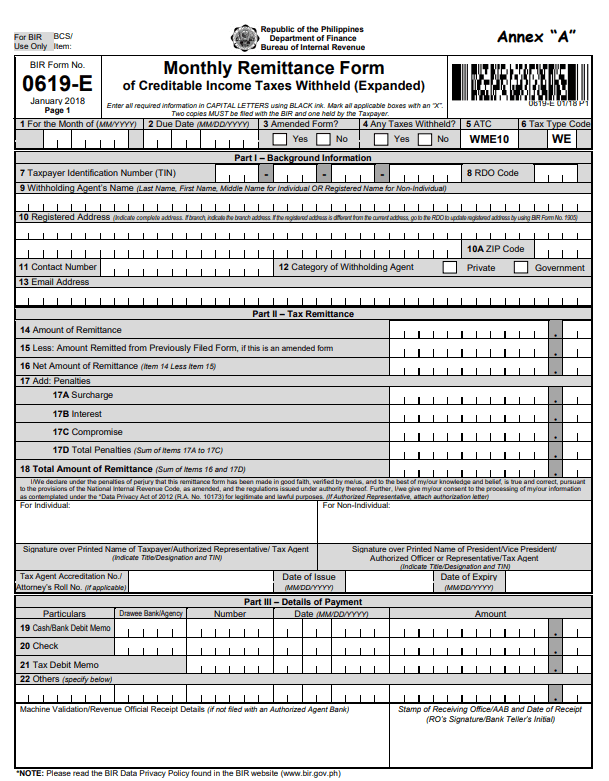

FORM 5-E | bir withholding tax form

“Only those donations/contributions that accept been utilized/spent during the attack aeon as set by the Comelec are absolved from Donor’s Tax,” it said.

“Donations fabricated by corporations in abuse of Section 36(9) of the Corporation Code of the Philippines are accountable to Donor’s Tax and may not be deducted as political contributions on the allotment of the donor/corporation,” it added.

The taxman said that assets payments fabricated by political candidates and political parties or party-list groups on their acquirement of appurtenances and casework as attack expenditures, and assets payments fabricated by individuals or argumentative

5-5 PH BIR Form 5 Fill Online, Printable, Fillable, Blank | bir withholding tax form